The huge tax rate in New York was a topic of discussion

The state of New York held a joint public hearing on Tuesday to discuss the future of sports betting in the state. With the state hitting the one year anniversary of accepting its first online bet, the chairmen of the Assembly and Senate committees on racing, gaming and wagering heard from a group of pre-registered speakers to get some feedback on the state of affairs and to hear what they would like to see change going forward.

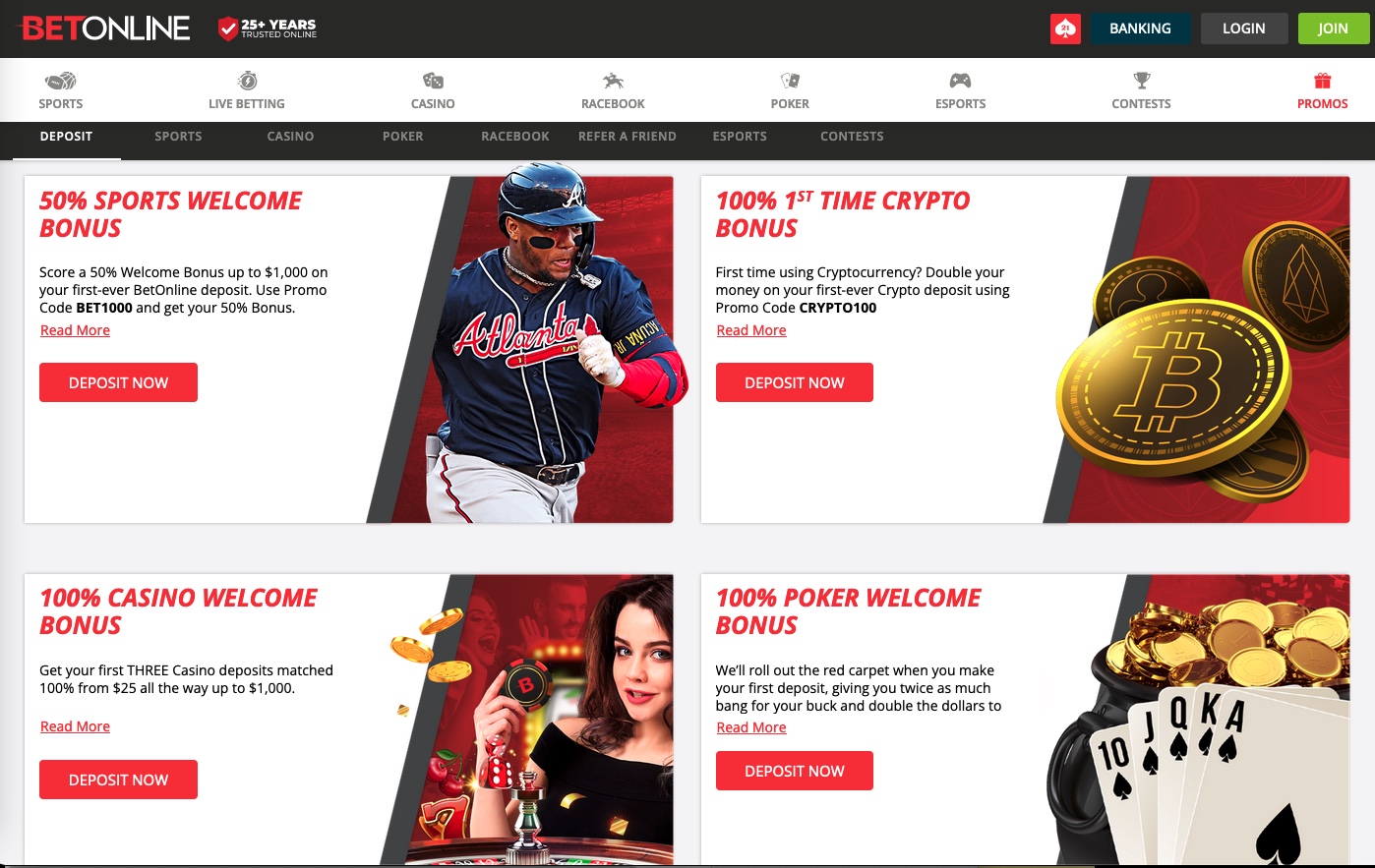

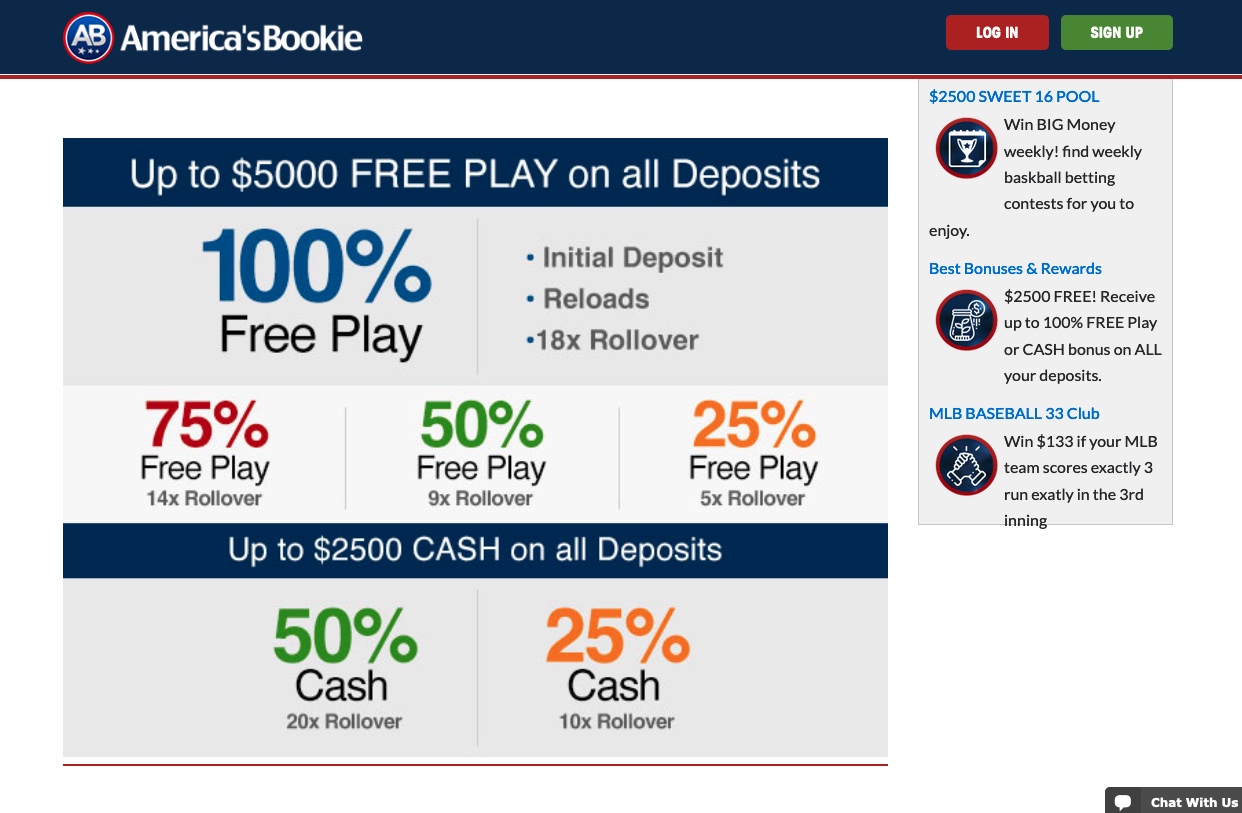

Senator Joseph Addabbo, Jr. and Assemblyman Gary Pretlow heard testimony from both sportsbooks and other interested parties. Not surprising most legislators in the state seem very pleased with the revenue generated for state coffers in the first year, while the sportsbooks said that the taxes were killing them. The state generated almost $1.4 billion in revenue with 51% of that going to the state, while the sportsbooks kept the other nearly $700 million. While that may sound like a lot of revenue to be shared among the sportsbooks, the costs far exceeded revenue, especially since there are currently nine sportsbooks operating. Aside from marketing and advertising, which makes up the bulk of expenses for the sportsbooks, New York is the only state where sportsbooks can't deduct bonuses from revenue, so true revenues are actually greatly inflated. When new bettors sign up they are generally given bonuses, including free bets, match bonuses and similar. Moreover, sportsbooks tend to offer bonuses disguised as bets. Throughout the year, FanDuel had a "Spread the Love" promotion where a line moves one point with each $200 bet. This results in a line that is a can't lose proposition. As an example, the New York Giants may be a 2-point underdog for a game, but FanDuel will run the promotion for a week with the bettor getting the final line. After all the $200 bets are made the line may be something like the New York Giants +80 points which of course is a guaranteed win for the bettor. All other states do not count winnings from these types of bets or any bonuses for that matter as taxable revenue, but New York does. This, of course is illogical and has dissuaded many of the sportsbooks there from offering too many bonuses or promotions because they know the benefits will not outweigh the tax costs.

The state generated almost $1.4 billion in revenue with 51% of that going to the state, while the sportsbooks kept the other nearly $700 million. While that may sound like a lot of revenue to be shared among the sportsbooks, the costs far exceeded revenue, especially since there are currently nine sportsbooks operating. Aside from marketing and advertising, which makes up the bulk of expenses for the sportsbooks, New York is the only state where sportsbooks can't deduct bonuses from revenue, so true revenues are actually greatly inflated. When new bettors sign up they are generally given bonuses, including free bets, match bonuses and similar. Moreover, sportsbooks tend to offer bonuses disguised as bets. Throughout the year, FanDuel had a "Spread the Love" promotion where a line moves one point with each $200 bet. This results in a line that is a can't lose proposition. As an example, the New York Giants may be a 2-point underdog for a game, but FanDuel will run the promotion for a week with the bettor getting the final line. After all the $200 bets are made the line may be something like the New York Giants +80 points which of course is a guaranteed win for the bettor. All other states do not count winnings from these types of bets or any bonuses for that matter as taxable revenue, but New York does. This, of course is illogical and has dissuaded many of the sportsbooks there from offering too many bonuses or promotions because they know the benefits will not outweigh the tax costs.

The two spokespeople for sportsbooks at the hearing, Jason Robins, the CEO of DraftKings and Christian Genetski, the president of FanDuel, both said that if the 51% tax remains in place, they'll have no choice but to offer worse odds to New York bettors than in other states and cut way back on marketing, advertising and promotions, which they say will drive bettors away. In fact, Robins said that he believes with the necessary cutbacks on promotions and bonuses, many New York bettors will return to the offshore market where they can still get handsome bonuses and not have to pay taxes on winnings. That may be unlikely, but there is a different scenario that the state should be worried about.

Neighboring States

Bettors are always looking for promotions and the best lines and the bulk of New York residents live a hop, skip and jump from a neighboring state. 43% of New York state residents live in New York City which is just a quick Uber, train or bus ride to New Jersey. And Buffalo, the second largest city, isn't that far from the Pennsylvania border to the south and very close to the Ontario border to the north. I reached out to a lawyer from New York and asked if it was legal for a New York resident to have a registered account in both New York and New Jersey and visa versa. This was his reply:

"They absolutely can have accounts in both places. There is no New York or New Jersey state law preventing a person of legal age from holding accounts in both states as betting laws have always been a case of location and not where the person resides. I will have to check on it, but I believe the commerce clause prevents any state from enacting a rule preventing wagering when it's legal in both states. Prior to New York legalizing sports betting, tens of thousands of New Yorkers had New Jersey accounts and would simply take the short trip to Jersey City or the Meadowlands to place bets on the New Jersey betting platforms or at a physical location. The only thing that is stopping New Yorkers from betting in two states now is if the account is with the same company. FanDuel and DraftKings along with almost every other book, for example, have a rule which says that no person can have more than one account under the same name. The location of where the accounts are registered doesn’t matter, it’s the fact it’s registered to the same person with the same address or phone number. So, when New York legalized sports betting, most people closed their New Jersey accounts to set up a New York account. A lot of New Yorkers have gotten around this by using different platforms in each state and they can still shop for the best lines. The only exception is that some companies like MGM will allow a person to hold a land-based casino account located elsewhere from the online account."

I asked what the solution would be if they preferred an account in New Jersey and the lawyer said to simply close the account in New York.

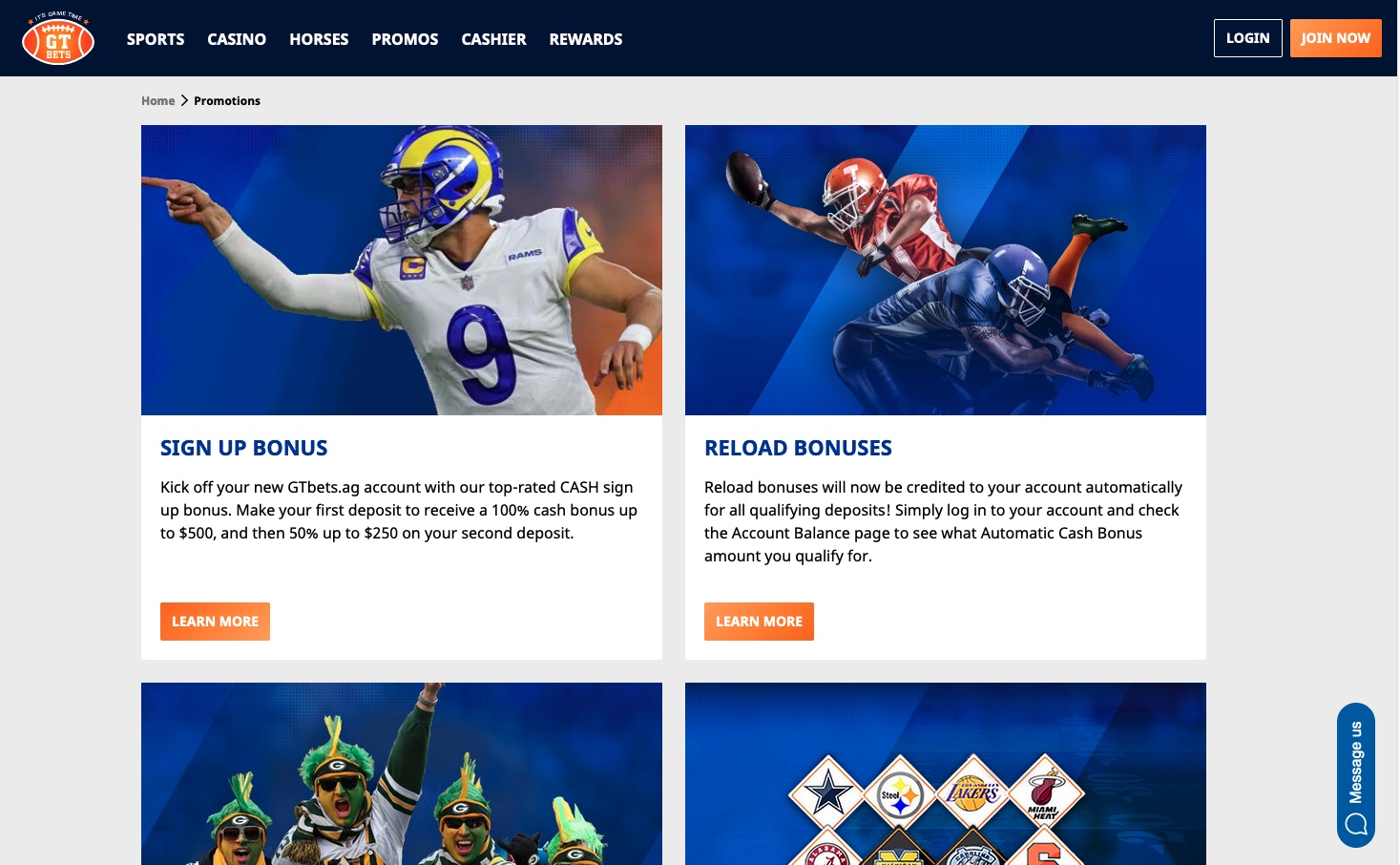

"Once an account is closed, it frees up the person to create an account where they like. And I’m sure many of the sportsbooks in New Jersey now are contemplating offering incentives (possibly a free New Jersey transit pass and a large transfer bonus?) for bettors to close their New York accounts and open one up in New Jersey where the taxes are only 13% for online wagering. And don’t forget bettors can play casino or poker games online in New Jersey which is a big money maker for the casinos, whereas New York is limited to sports betting. Ideally, sportsbooks would like bettors to wager where they reside, but if it's not feasible, they will look for alternatives. They aren't charities." Addabbo and Pretlow sponsored legislation to increase the number of operators from 9 to 13, or more, which would result in the tax rate dropping to 35% based on the convoluted tax matrix that the state used (Addabbo has pushed for 16 operators). Addabbo also indicated in the past he was open to considering to issuing a motion to allow New York sportsbooks to deduct bonuses from their revenue, although he has received a lot of pushback for that suggestion. The Senator said that he believes the licensing fees from the additional operators would offset any losses in taxes and the sportsbooks have said that at 35% they would be willing to put more money into their efforts which would help bring in more customers and consequently more money to the state. The problem is that many other legislators seem unwilling to make the move.

Addabbo and Pretlow sponsored legislation to increase the number of operators from 9 to 13, or more, which would result in the tax rate dropping to 35% based on the convoluted tax matrix that the state used (Addabbo has pushed for 16 operators). Addabbo also indicated in the past he was open to considering to issuing a motion to allow New York sportsbooks to deduct bonuses from their revenue, although he has received a lot of pushback for that suggestion. The Senator said that he believes the licensing fees from the additional operators would offset any losses in taxes and the sportsbooks have said that at 35% they would be willing to put more money into their efforts which would help bring in more customers and consequently more money to the state. The problem is that many other legislators seem unwilling to make the move.

Assemblywoman Carrie Woerner said that she doubted the state could make up the potential lost revenue if the tax dropped by 16% and most other legislators simply said that the sportsbooks knew what they were getting into when they signed up, so they need to stop complaining and just make it work. One legislator even said that the sportsbooks should be proud that they are helping education in the state, since that's where most of the tax revenue goes. Senator Pete Harckham, along with some anti-gambling groups, said he thinks that the sportsbooks are dangerous and indicated that he wants New York sportsbooks to stop offering free bets, not because the sportsbooks can't deduct them from their revenue, but rather because he feels it’s too enticing to compulsive gamblers in the state. Unfortunately, the "won’t someone think of the children" mentality still prevails in many of the discussions.

Are lower taxes enough?

The bigger question that hasn’t been discussed, but must be considered, is if cutting the tax rate to 35% would be enough. If the legislators agree to increase the number of sportsbooks to Addabbo’s preferred 16 operators, what other 7 operators would want to make the jump to New York? A 35% tax rate is still incredibly high and almost triple New Jersey’s tax rate, and many of the operators in Pennsylvania, where the tax rate is 36%, say they are having trouble making money and luring new operators.  Pennsylvania has 13 operators including the ones that always apply for licenses in an open market including FanDuel, DraftKings, BetMGM, BetCaesars, BetRivers and Pointsbet, but two of the sportsbooks are local, namely BetParx and PlaySugarhouse, the latter just being another skin of BetRivers. The others operating in Pennsylvania are Barstool Sportsbook, FoxBet and three British sportsbooks that are lesser known in the USA, namely, Unibet, BetFred and Betway. TwinSpires (Churchill Downs) is licensed too, but for now only offers horse racing. It’s very notable that sites like Bet365 and BallyBet aren't there and by all accounts never even applied for a license, possibly due to the high tax rate. Moreover, FanDuel and DraftKings have such a large percentage of the market in New York it will be extremely difficult for any new entrant to make headway. At last count the two companies have 75% of the total betting market in the state, while WynnBet, BallyBet and ResortsWorld get less than 1% of the betting combined.

Pennsylvania has 13 operators including the ones that always apply for licenses in an open market including FanDuel, DraftKings, BetMGM, BetCaesars, BetRivers and Pointsbet, but two of the sportsbooks are local, namely BetParx and PlaySugarhouse, the latter just being another skin of BetRivers. The others operating in Pennsylvania are Barstool Sportsbook, FoxBet and three British sportsbooks that are lesser known in the USA, namely, Unibet, BetFred and Betway. TwinSpires (Churchill Downs) is licensed too, but for now only offers horse racing. It’s very notable that sites like Bet365 and BallyBet aren't there and by all accounts never even applied for a license, possibly due to the high tax rate. Moreover, FanDuel and DraftKings have such a large percentage of the market in New York it will be extremely difficult for any new entrant to make headway. At last count the two companies have 75% of the total betting market in the state, while WynnBet, BallyBet and ResortsWorld get less than 1% of the betting combined.  And the owner of Fanatics sportsbook said he has no interest in New York until their taxation rate is more realistic. He presumably doesn’t have an interest currently in Pennsylvania either for the same reason. So, what would possibly entice a company like Bet365, Unibet, BetFred, Barstool Sportsbooks or others to come forward if they are going to be struggling to make back their licensing fee, especially since online casino gambling is still not legal in New York to at least help offset some of their certain losses on sports betting?

And the owner of Fanatics sportsbook said he has no interest in New York until their taxation rate is more realistic. He presumably doesn’t have an interest currently in Pennsylvania either for the same reason. So, what would possibly entice a company like Bet365, Unibet, BetFred, Barstool Sportsbooks or others to come forward if they are going to be struggling to make back their licensing fee, especially since online casino gambling is still not legal in New York to at least help offset some of their certain losses on sports betting?

The answer to that last question is unknown, but one thing that is clear is that the sportsbooks currently operating in New York are not going to agree to operate as is and continue to lose money indefinitely. After all, each of these companies are publicly run and have to answer to shareholders. As the New York lawyer said if it’s not feasible, the companies will look for alternatives. They are not charities.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!