To many in the sports wagering industry, May 14, 2018 might be more significant than July 4, 1776 is to Americans. In a way, they have something in common. That is, celebrating a form of independence and freedom.

Without a ridiculous comparison, that was the day PASPA (the Professional and Amateur Sports Protection Act of 1992) was repealed by the U.S. Supreme Court, igniting the stage we continually see today for legalized sports wagering including online sports betting.

To appreciate it, one would have to travel back to the courtrooms witnessing the amount of money the U.S. pro sports leagues were spending to lobby against legalized wagering. Using their political muscle to convince all federal judges and legislators that people betting on sports was a crime that would destroy lives and end the fair balance of both professional and collegiate sporting events.

It was quite effective for several years as the late billionaire Sheldon Adelson, CEO of the Las Vegas Sands helped also financially fuel the legislative war against one dollar of “online wagering” ever being bet legally within the U.S.

While the NBA and Major League Baseball were somewhat sitting on the fence, the NFL was doggedly leading the charge with their attorneys to never allow PASPA to be repealed through three federal court hearings, backed by prominent political forces. Not too long ago, early in 2017, any bookmaker would have given you 100-1 we would have seen the PASPA reversal become the biggest longshot bet of the decade.

Big Flash Forward Tune in to any NBA game on TV today and it’s impossible to witness a dribble without a FanDuel or DraftKings logo or ad staring you in the face. Sports wagering commercials far outnumber beer commercials. They are broadcast nationally on every basketball and baseball game when only half the U.S. has legalized sports wagering. But still the largest opportunity states including Florida, Texas, and California do not.

Tune in to any NBA game on TV today and it’s impossible to witness a dribble without a FanDuel or DraftKings logo or ad staring you in the face. Sports wagering commercials far outnumber beer commercials. They are broadcast nationally on every basketball and baseball game when only half the U.S. has legalized sports wagering. But still the largest opportunity states including Florida, Texas, and California do not.

Not surprisingly, a company like DraftKings has posted large net losses despite ample revenue gain because they are overspending millions in advertising and marketing. Huh? Though “Wall Street experts” still applaud the plan and award them and others high ratings, do they basically understand they are selling GAMBLING, not goods or services?

Ironically, COVID-19 and the Coronavirus have been the greatest unplanned asset for sports wagering to explode within the U.S. At its restrictive casino attendance peak late in 2020, some states including New Jersey and Pennsylvania were reporting online wagering share over 90%. That average online figure is not expected to diminish greatly despite the virus hopefully decreasing later in 2021. New Jersey’s handle almost eclipsed $1 billion last December and undoubtedly will break that mark sometime during a month in the upcoming football season.

As for the NFL, perhaps the greatest hypocrisy of all. Look for ESPN and the major networks devoting ample time and specified programs devoted solely to NFL football odds and proposition wagers, sponsored by DraftKings, FanDuel, BetMGM and other league-approved advertisers. Al Michaels will hardly have to hide his glib hidden references to point totals on one-sided Sunday Night Football any longer.

Loyalty a Huge Factor

When PASPA was reversed three years ago this Friday, it was predicted to end the offshore wagering industry’s hold on sports betting that began in the U.S. late in the 1990’s. It hasn’t. Though no official data is available to the exact decrease it has been thought of somewhat of a surprise due to lack of loyal player movement.

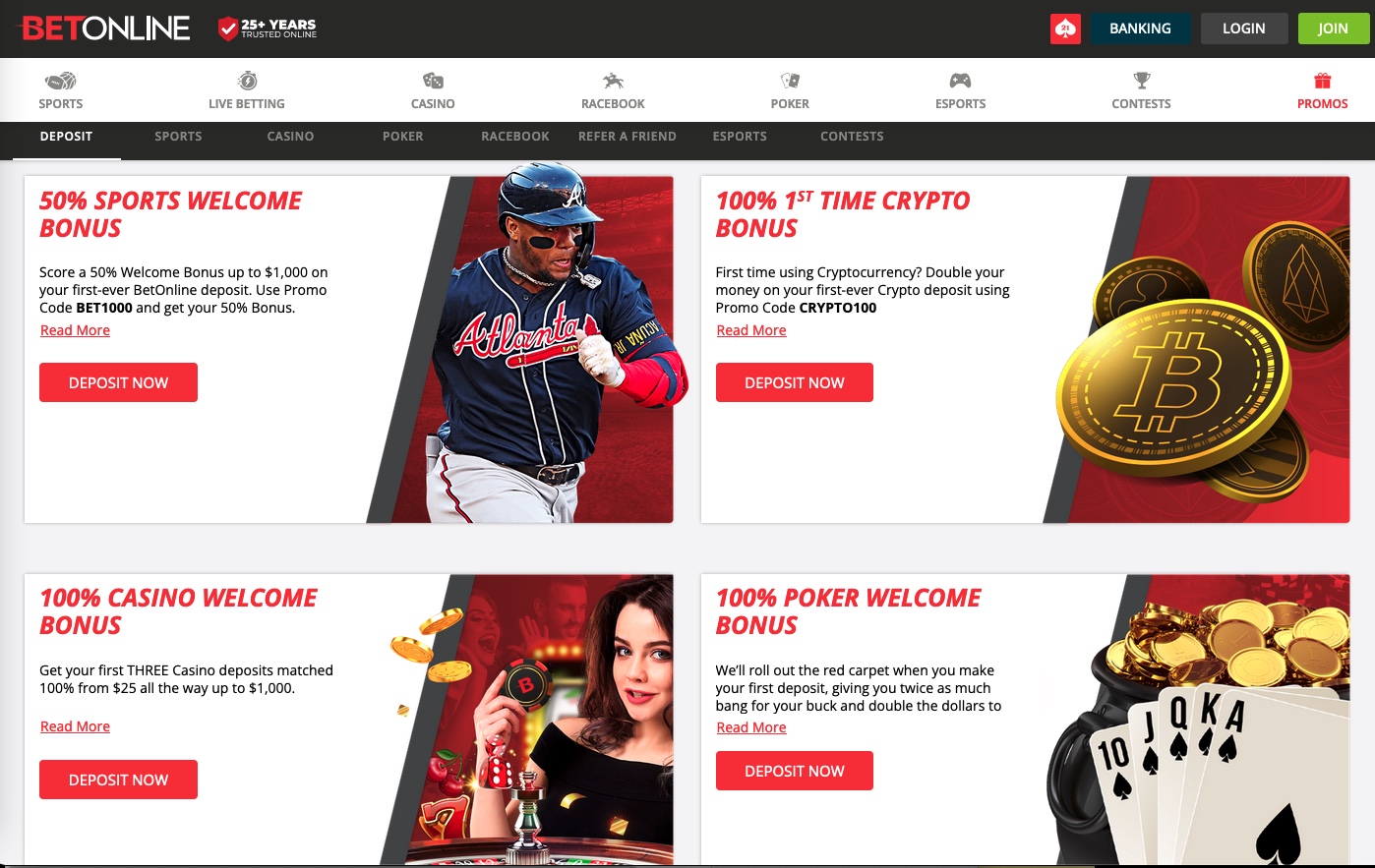

A reasonable number of new customers have come from just that…new customers. New sports bettors that have not previously obtained accounts offshore. Lured by substantial incentive bonuses, they have also drained sportsbook revenue pools but have provided new operators with the beginning base they crave.

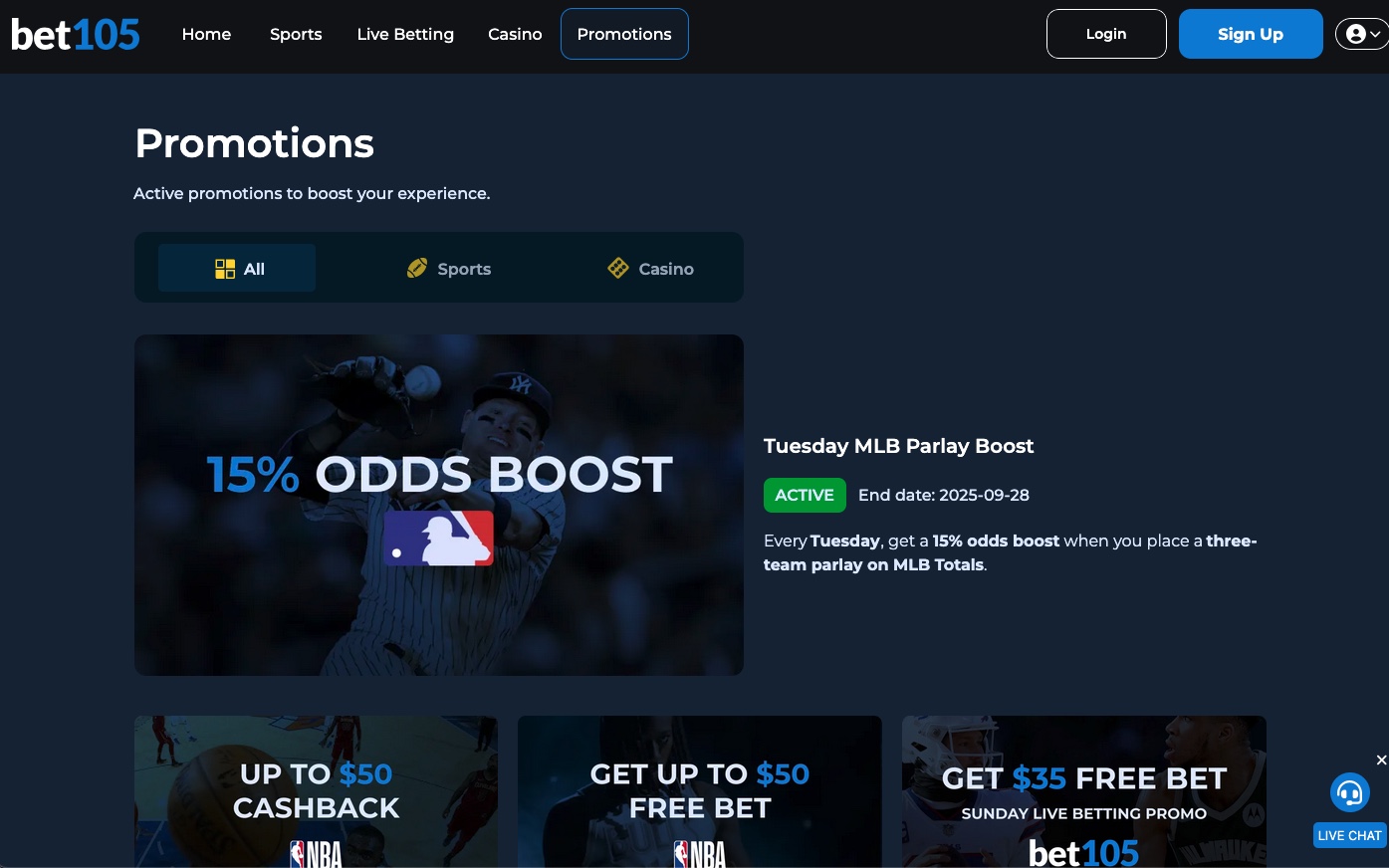

Also on their side is that sports bettors often unwisely remain loyal to one sportsbook source, despite having the opportunity to choose lines from several. Many of the top offshore sportsbooks like Bovada, WagerWeb, Bookmaker and others offer similar (or better) incentive offers competing with the new books available in each U.S. state. With long proven customer service and good payment processing, many players have chosen to stay intact.

Also, with no restrictions on any in-state sports betting, a larger menu plus no laws against several proposition wagers including politics offer an attractive alternative for the top offshore sportsbooks. Or perhaps it’s just a “if it’s not broke, don’t fix it attitude” that’s driving loyalty for many customers to remain.

5Dimes Lookout

The million-dollar question or should we say "multi-million-dollar question" will be whether the U.S. government will allow offshore wagering behemoth 5Dimes to legally return to obtain state licenses in the near future. Last September 5Dimes agreed to pay $15 million in cash, forfeit more than $30 million in assets and stop accepting wagers from U.S. customers while operating out of Costa Rica. This according to the settlement agreement reached with the U.S. Attorney's Office for the Eastern District of Pennsylvania.

Last September 5Dimes agreed to pay $15 million in cash, forfeit more than $30 million in assets and stop accepting wagers from U.S. customers while operating out of Costa Rica. This according to the settlement agreement reached with the U.S. Attorney's Office for the Eastern District of Pennsylvania.

The non-prosecution agreement allows 5Dimes and CEO Laura Varela, wife of slain owner William Sean Creighton to potentially pursue opportunities in the U.S. sports betting market. Varela fully cooperated with the investigation including significant changes to 5Dimes's operations that make it possible to participate in lawful gaming operations across the world according to the settlement agreement. That obviously includes the United States as a primary target.

On September 7, 5Dimes included a notice on their website that it would stop accepting wagers from U.S. based customers and that all requests for payment would be turned over to Epiq, a third-party processor for distribution. And that any funds not claimed by September 30, 2020 would be forfeited to the U.S. government as per negotiated rules in the settlement.

In basic math this $46 million dollar settlement could be a potential template for another major sportsbook to possibly follow suit going forward. A similar forfeit of assets to the U.S. government could provide a major financial reward for any of the top offshore sportsbooks. The opportunity to gain licenses in unlimited states would be theoretically valuable accompanying their giant lists of loyal, satisfied customers.

The PASPA Reversal Three Years From Now It would be difficult to make “ice-cold lock” predictions upon the U.S. regarding the effects of PASPA’s reversal three years from now. The announcement on May 14, 2018 was so stunning and what has taken place since so quickly is mind-bending. Then again, in some ways, some of the things that did NOT happen are equally puzzling and have been disappointing to many.

It would be difficult to make “ice-cold lock” predictions upon the U.S. regarding the effects of PASPA’s reversal three years from now. The announcement on May 14, 2018 was so stunning and what has taken place since so quickly is mind-bending. Then again, in some ways, some of the things that did NOT happen are equally puzzling and have been disappointing to many.

Expect that most U.S. states will have some form of legalized sports wagering including Florida, Texas, and California by then. States desperate for new tax funding will dictate that. How the rules will work among each individual state is anybody’s guess. Also don’t always expect them to be to a bettor’s advantage.

Any financial forecast would be beyond speculative. No doubt the market will grow but until sportsbooks begin to harness their spending on advertising, marketing, and paying the pro leagues I cannot envision the bottom line exploding. Just when will someone wake-up to understand this is a business based entirely on “gambling”. Tough to forecast accurate quarterly and yearly figures on that.

Glenn Greene covers the games from a betting angle every week exclusively at OSGA.com. For weekly betting insights, including previews and picks from Glenn, click here.