A recap of the 2022 Canadian Gaming Summit

The Canadian Gaming Summit last week in Toronto was the first in-person crowd for the conference in three years, was well attended and featured speakers and exhibitors from Canada, the United States and Europe. The conference celebrated the opening of online gambling in Ontario on April 4th and was primarily focused on what was learned in the two months since the opening, as well as a look forward for not only Ontario, but the rest of Canada as well. While many of the sessions rehashed what is already known and provided mostly generalities there were some interesting takeaways from the sessions

Ontario is open to anyone interested

The most interesting and perhaps surprising revelation occurred in the Wednesday morning keynote session (the first official session) when the Ontario Attorney General and speakers from iGaming Ontario and the Alcohol and Gaming Commission of Ontario (AGCO) indicated that they were giving six months for all online operators to abandon their current situation and apply for an Ontario license. I talked to one of the panelists who confirmed that Ontario was willing to consider applications for any licensee as long as they paid the $100,000 fee and agreed to pay 20% of the profits to the province. Unlike many other jurisdictions, there is no bad actor clause or time out period and there is no whitelist of eligible jurisdictions, like there was in the U.K. While the province promises to do background checks on all principals, it is mostly to see that they are not guilty of serious crimes like murder, robbery or money laundering. One of the speakers told me that even if principals have a warrant out for their arrest from the FBI, it wouldn’t necessarily exclude them from getting an Ontario license as the province will evaluate the offense against Canadian laws and determine if the offense would exclude them from operating in the country. Consequently, operators from sites in Costa Rica, Antigua, Kahnawake, Belize etc. can likely get a license if they choose to, unless the company did something egregious.

I talked to one of the panelists who confirmed that Ontario was willing to consider applications for any licensee as long as they paid the $100,000 fee and agreed to pay 20% of the profits to the province. Unlike many other jurisdictions, there is no bad actor clause or time out period and there is no whitelist of eligible jurisdictions, like there was in the U.K. While the province promises to do background checks on all principals, it is mostly to see that they are not guilty of serious crimes like murder, robbery or money laundering. One of the speakers told me that even if principals have a warrant out for their arrest from the FBI, it wouldn’t necessarily exclude them from getting an Ontario license as the province will evaluate the offense against Canadian laws and determine if the offense would exclude them from operating in the country. Consequently, operators from sites in Costa Rica, Antigua, Kahnawake, Belize etc. can likely get a license if they choose to, unless the company did something egregious.

Number of operators expected to be massive

There are apparently 40 applications that either were issued or are being evaluated by iGaming Ontario and based on interest that number is expected to reach close to 70 by year end. That includes both B2B and B2C companies operating in the space. While that number is impressive, it is also understood that not everyone can survive with that much competition. Fitzdares, for example, has yet to launch even though they were one of the first companies licensed and Tristan Wooton, Director of Growth for the company said that the vast majority of their revenue in the UK is from horse racing, but Ontario law disallows any sportsbooks from offering horse racing products. Wooton did say the company will launch in Ontario soon, but gave no firm date. Consequently, there are expected to be many mergers and companies just withdrawing altogether. One speaker, a former head of AGCO, did say that the competition alone shouldn’t scare minor players though.

"Not everyone needs 100,000 players to be successful," Don Bourgeois said in a forum on regulation. "Some companies can still be profitable with 2,000 players if they don’t need to advertise or hire a lot of staff."

Indeed, companies like Pinnacle Sports, Bodog and Heritage Sports have a very loyal following from Ontario and can likely be quite successful just from their current clientele and word of mouth. What being regulated in Ontario would provide them is more payment options as well as a lead into the rest of North America should jurisdictional restrictions be lifted. It should be noted that Pinnacle Sports has applied for an Ontario license.

Ontario won't license affiliates, geolocation companies, payment providers and other ancillary companies

Some affiliate companies, like Covers, were hoping that the government would issue licenses to all B2B businesses, including affiliates, geolocation companies, payment providers, etc. with the hope that licensed gambling operators would then only accept advertising from the licensed affiliates. They believed it was in everyone’s interest to exclude all non-licensed B2B companies from advertising with licensed Ontario gambling companies to ensure that everyone is working in compliance with the rules set out by the province. They also hoped that any operators that did accept advertising from unlicensed sources government would face penalties.

The panel said, however, that the Ontario government indicated they weren't currently looking at that option and thus they believed the government was effectively encouraging a "wild west" strategy, whereby affiliates advertise and get revenue from both regulated and unregulated gambling sites, particularly since there was no real penalties that could be enforced against companies who continued to cater to Ontario without a license. Similarly, there is no incentive for geolocation and other providers to work solely within regulated markets if there are no disincentives. In the U.S. many states do require anyone providing services to be licensed regardless of whether they are a B2B or B2C company.

The federal criminal code is preventing DFS, poker and games requiring liquidity

When DraftKings and FanDuel left the Ontario DFS market, many believed it was because the province told them those products weren’t allowed. That, however, is not the case. The issue with DFS and poker games is that the Canadian criminal code will only allow provinces to accept bets taking place completely within the province. The code provides exemptions for lotteries and horse racing but for all other products, the bets must be completely intraprovincial. There are approximately 15 million people living in Ontario and about 11 million in the legal gambling age of 19 and over, but that isn’t enough to create any meaningful contests for DFS or poker tournaments. DFS is still a fairly niche product and the only reason it is successful is that players from across the world play in the same pools, with the vast majority in the United States. Daily fantasy sports is currently only illegal in some of the northwestern states as well as Alaska and Hawaii, meaning that approximately 250 million Americans, along with 20 million Canadians outside of Ontario, can bet on DFS.  Even with those figures there are only eight million registered DFS players at DraftKings and about 10 million at FanDuel, or about 6% of the population. Pools need liquidity to work, so with only the Ontario population it would be almost impossible for the sites to be profitable offering DFS. Similarly, poker requires full tables and liquidity to be successful and there just aren’t enough Ontario poker players to be meaningful. Currently only 888 and BetMGM offer poker in Ontario on their iGaming Ontario licensed sites and there are less than 100 players at any time. GGPoker and PokerStars are expected to enter the market soon although they may be having second thoughts according to sources, since they know they will have mostly empty tables as an Ontario-only product. Adam Greenblatt, the CEO of BetMGM told me that he doesn’t believe poker will be a successful product in Ontario unless the rules change.

Even with those figures there are only eight million registered DFS players at DraftKings and about 10 million at FanDuel, or about 6% of the population. Pools need liquidity to work, so with only the Ontario population it would be almost impossible for the sites to be profitable offering DFS. Similarly, poker requires full tables and liquidity to be successful and there just aren’t enough Ontario poker players to be meaningful. Currently only 888 and BetMGM offer poker in Ontario on their iGaming Ontario licensed sites and there are less than 100 players at any time. GGPoker and PokerStars are expected to enter the market soon although they may be having second thoughts according to sources, since they know they will have mostly empty tables as an Ontario-only product. Adam Greenblatt, the CEO of BetMGM told me that he doesn’t believe poker will be a successful product in Ontario unless the rules change.

In order for the rules to change, all provinces must be unanimous in requesting a change to the criminal code as happened with single game sports betting in 2010 and dice games at land-based casinos which were illegal until 1999. But even if all provinces agreed to the change the law, DFS would likely still not be profitable unless the country could reach a deal with the U.S. That might be difficult, however, since lifting international restrictions could be seen as a violation of the Wire Act and UIGEA.

The Ontario Government is being inundated with complaints about advertising

The AGCO put out rules related to advertising and marketing in section 2.03 to 2.07 of the Registrar’s Standards for Internet Gambling and the rules state that the communications must meet the following criteria:

- It cannot target high-risk, underage or self-excluded individuals

- It must be truthful and cannot mislead players or misrepresent the product, such as making players believe it’s a money making opportunity or can improve one’s image

- Player’s must be given an opt out from receiving communications from the company

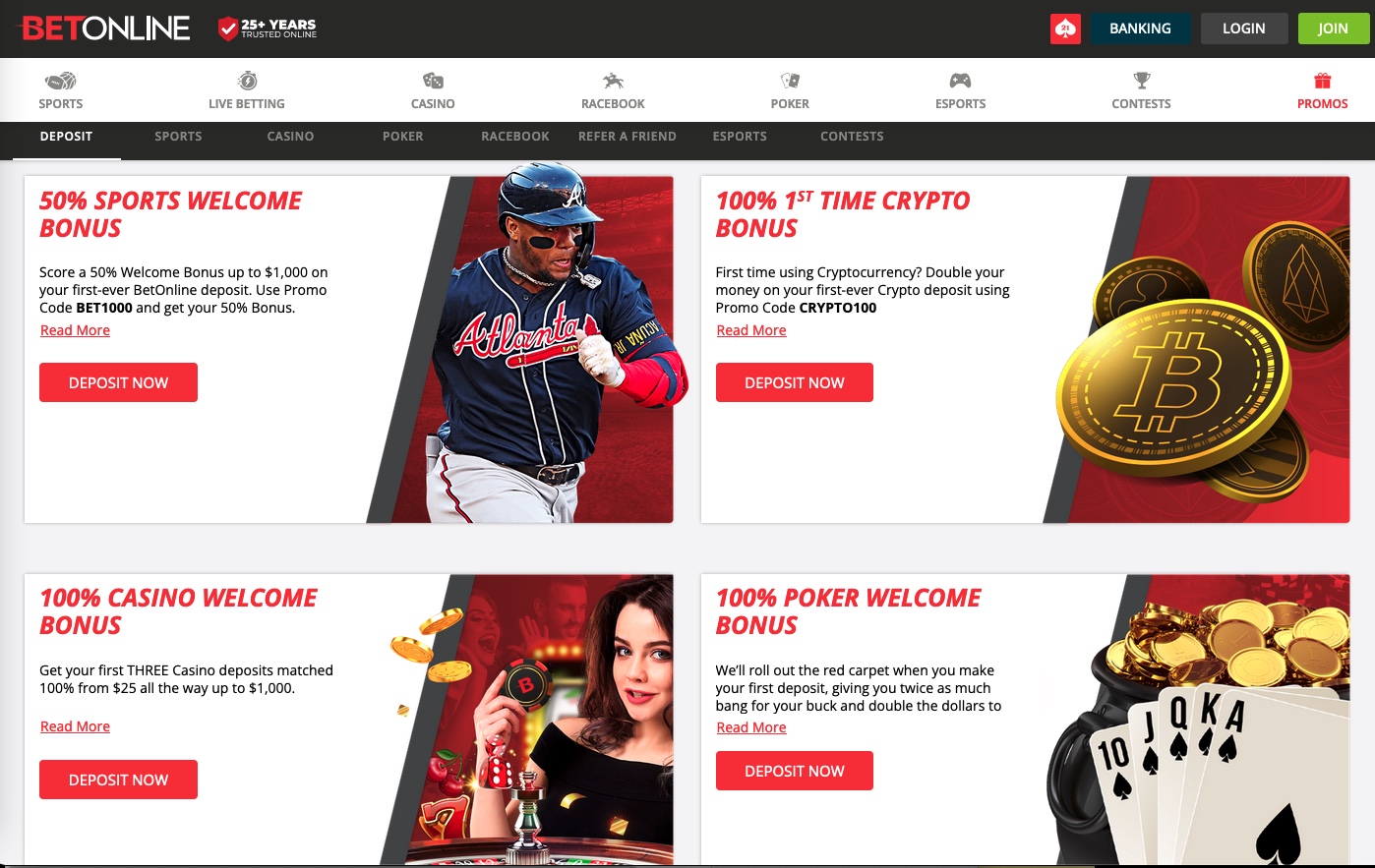

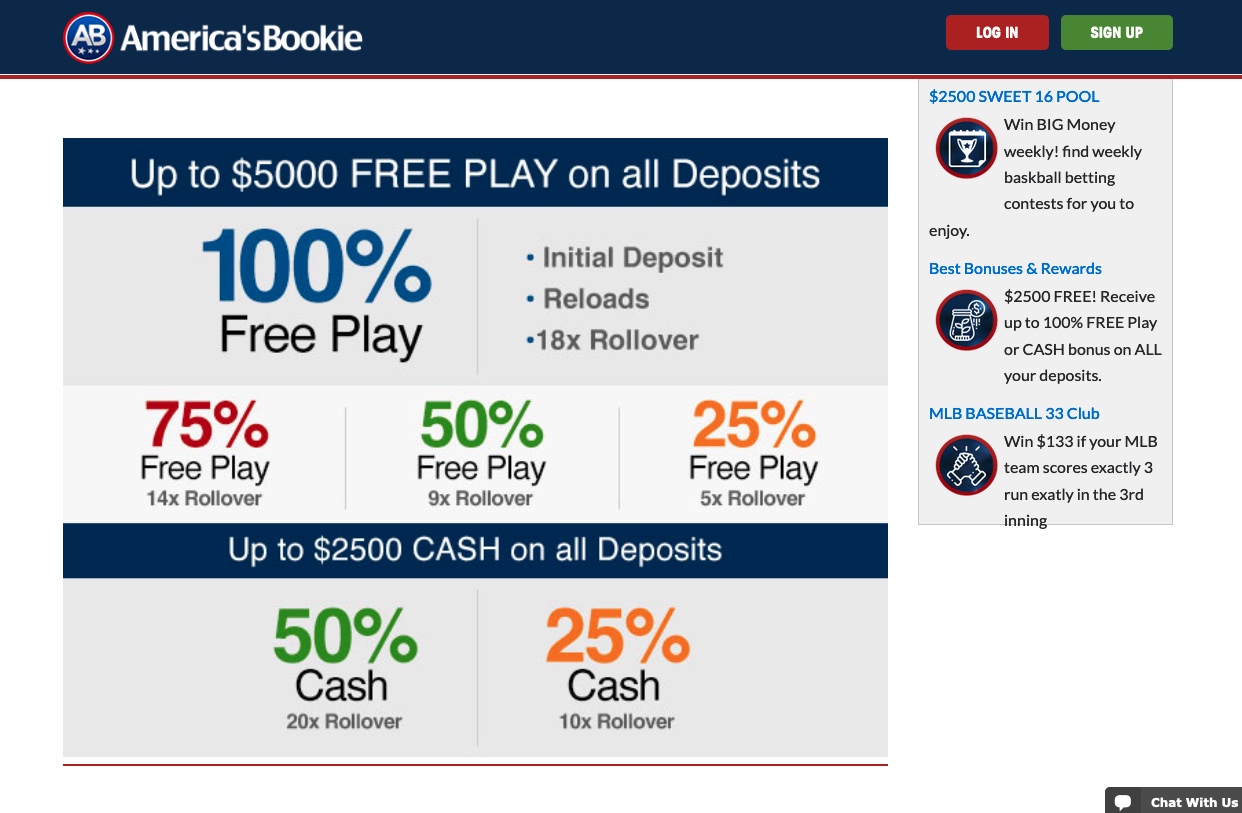

- Any bonuses, incentives, credits etc. can only be advertised on the company’s site or in their direct advertising to players after receiving permission from the customer

The full rules can be found on the AGCO website.

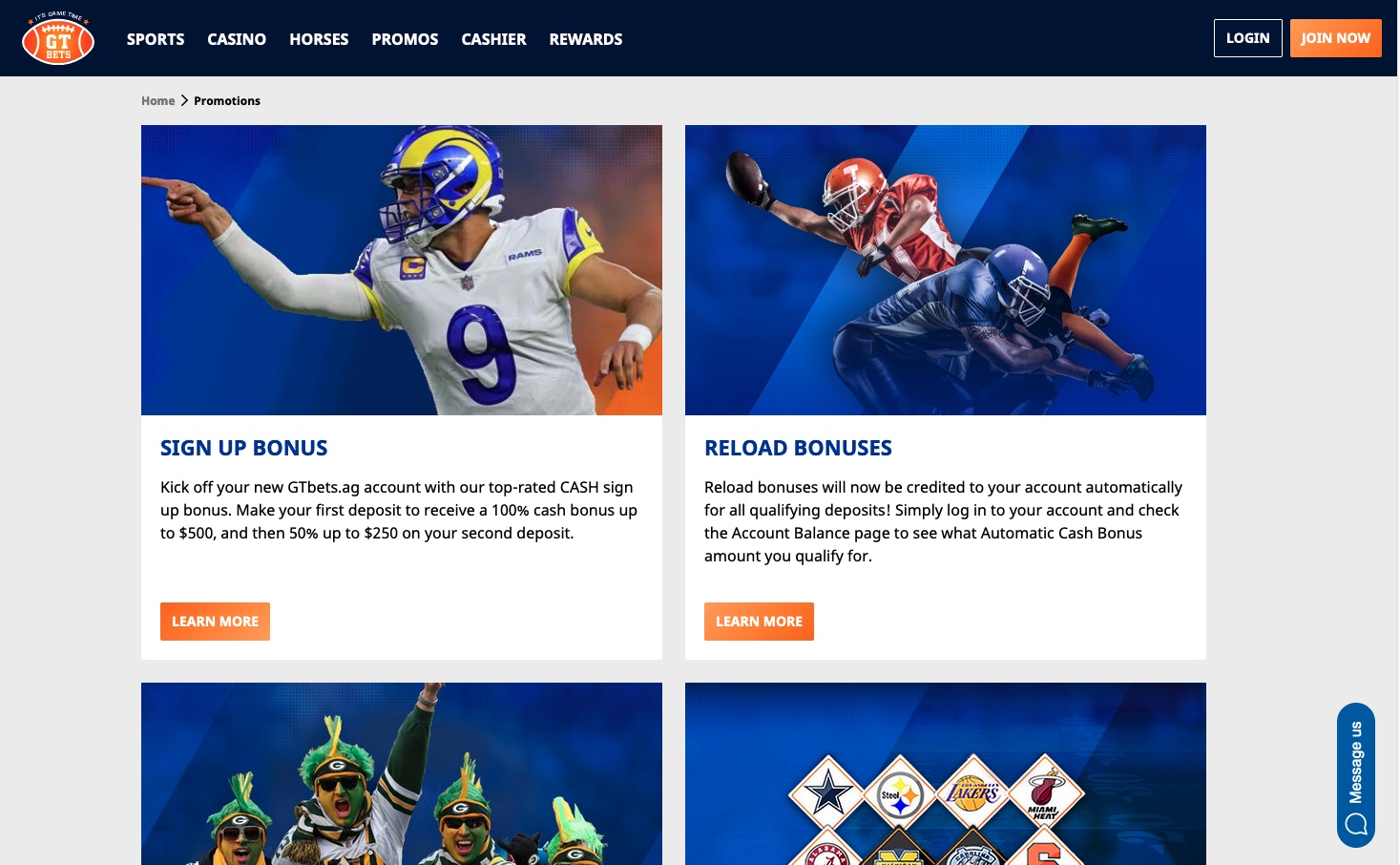

A couple of companies have already received fines for advertising sign-up bonuses on TV and one company received a fine for misleading advertising. At the same time there are no rules indicating the type of media that can be advertised nor are there any restrictions on when gambling can be advertised. Consequently, Ontarians are seeing advertising for online sportsbooks and casinos day and night on all stations (except during children’s programming), and it includes television, radio, newspapers, and billboards. This has led to the AGCO receiving multiple complaints about the amount of advertising and how inappropriate it is, and some viewers have said that one out of every three ads is for an online sportsbook or casino. In turn, the government has asked the gambling companies to voluntarily curtail some of their advertising, but there is no plan in place to limit the timing or amount of advertising as has been the case in the UK and Australia.

One speaker at a session on responsible gambling told me that the companies may be shooting themselves in the foot with their actions:

"No one ever considers the long term. I realize it's important to build brand awareness and loyalty but over time these companies may turn off potential clients with their advertising to the point where one won’t sign up simply because they view the company as a pariah. It’s happened elsewhere in the world, and it will happen in Ontario. The key is to advertise at the right time and place. And what most are doing now is not that."

Land-based casinos want to build a true omnichannel and are set to launch online

Several land-based casinos are set to launch online sites in Canada beginning with Mohegan Sun, which owns the two casinos in Niagara Falls, Canada. Richard Roberts, President of Mohegan Digital, told me that the company will launch sometime this month and that Play Fallsview, which to date was a free to play casino site, will now become a real money site. It is not expected that Casino Windsor, run by Caesars Entertainment will launch a site since BetCaesars is already operating in Ontario, but Casino Rama owned by The Chippewa Nation and OLG and run by Gateway Casinos may launch a site.  In addition, Great Canadian Gaming, which runs casinos at Woodbine, Pickering, and Port Perry, is looking to get into the online game. Great Canadian may have egg on their face when they launch an online casino, however, as they commissioned a report to show the province stood to lose $2 billion and thousands of jobs over five years with the launch of Internet casinos, which almost everyone realizes is an exaggeration and possibly untrue. All of the other land-based casinos in Ontario are owned and run by OLG. The Ontario Lottery Corporation has been running an online casino since 2016 and sports betting in the last couple of years after the single game sportsbetting law was struck down.

In addition, Great Canadian Gaming, which runs casinos at Woodbine, Pickering, and Port Perry, is looking to get into the online game. Great Canadian may have egg on their face when they launch an online casino, however, as they commissioned a report to show the province stood to lose $2 billion and thousands of jobs over five years with the launch of Internet casinos, which almost everyone realizes is an exaggeration and possibly untrue. All of the other land-based casinos in Ontario are owned and run by OLG. The Ontario Lottery Corporation has been running an online casino since 2016 and sports betting in the last couple of years after the single game sportsbetting law was struck down.

Roberts did indicate that he wants Mohegan Digital to be a true omnichannel, meaning that there would be no difference in play, payments and other metrics for patrons, whether they are playing at a land-based casino, on a mobile device or on a desktop/laptop. Rewards points would accumulate regardless of the platform used. BetCaesars and BetMGM have already integrated their rewards and it is expected that Great Canadian would do the same by combining the One Rewards card with any play on the website. Also, as part of the omnichannel, the companies are all looking to increase their live casino games, a type of streaming where a live dealer is playing the cards in front of the players. By doing so players can see the deal and at some point hopefully interact with the dealer and other players, thus knowing that the game is truly random and not set to a predetermined payout such as table game/slots offered by SG Digital, Microgaming and some other software providers. As one of the patrons said to me:

"The huge benefit of live casino games is that you can play your favorite game like blackjack, craps, Let it Ride, hold 'em etc. without having to mortgage the house to play $25 or $50 per hand like you do at a land-based casino."

Companies are looking at cryptocurrency, but not as a method for playing

Bitcoin and other cryptocurrencies were being discussed at various sessions and the general consensus was that some websites may look at Bitcoin, Ethereum and other cryptocurrencies, but only for exchange to Canadian dollars. One of the rules currently in Ontario is that all bets must be made in Canadian dollars, and no one expects that to change. So, several sites are in talks with crypto exchanges to see if there is a way to exchange crypto to CAD without high costs or delays. That is actually the process done by most offshore companies now, although some have created their own exchanges. The companies did, however, say that they may revisit the situation if Canada ever creates a central bank digital currency, and they are also looking at stablecoins. Before they can implement these changes, however, they will have to work with the Ontario government to ensure it is in line with the rules.

No other provinces appear ready to follow Ontario any time soon

The consensus seems to be that Alberta and Saskatchewan will likely be the next provinces to create an open market, but there are no concrete plans yet. Other governments do not seem so keen to follow suit.

The Atlantic Lottery Corporation, which represents New Brunswick, Prince Edward Island, Nova Scotia and Newfoundland seem keen to be the sole provider of gambling to the provinces, plus many in the ALC believe what Ontario is doing may not actually be legal, since Canadian law requires the governments to be involved in all parts of gambling. British Columbia and Manitoba seem happy with the Playnow.com website operated by SG Digital and owned by the governments and Quebec seems happy with their monopoly too. Moreover, the tax laws and rules in Quebec could be a huge disincentive to the gambling sites. The Territories are likely too small and poor to lure any interest by gambling sites.

So, the Canadian Gaming Summit turned out to be an interesting event and it was nice to be able to participate in a conference that was not virtual only. It is evident that Ontario is a huge market, but even with 11 million eligible citizens it is hard to be profitable competing with up to 70 other sites as there is only so much disposable income to go around. The next conference is the SBC North America Conference being held at the Meadowlands Convention Centre in July and OSGA will cover any interesting developments or insights from that conference as well. Sports betting is expanding almost everywhere in the United States, and it seems only a matter of time before every state except Utah, Hawaii, Alaska and likely Texas doesn’t have gambling. But even in a country like the U.S. there does come a point where there are too many operators.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!