More takeaways from the SBC gambling conference

In the conclusion of this two-part article I'll provide five additional takeaways from the SBC Summit North America gambling conference that hit home the most. Most of the information came from the sessions themselves, although some nuggets of insight came from discussions with speakers after the sessions and personal discussions at the exhibits. The highlights and insights are in no particular order.

6. Sportsbooks are still mostly concentrating on influencers, although affiliates are more profitable

An interesting topic at the conference was about influencers versus affiliates. In Europe, and other parts of the world, affiliates drive about 30% of revenue, but in the U.S. and Canada sportsbooks have turned to influencers to promote their brands.  Viewers in both countries can’t turn on a TV or see a billboard without the likes of Wayne Gretzky, Allen Iverson, Peyton Manning, Jamie Foxx or Ben Affleck promoting a large sports betting company. And on social media, sports betting giants are turning to influencers on those platforms.

Viewers in both countries can’t turn on a TV or see a billboard without the likes of Wayne Gretzky, Allen Iverson, Peyton Manning, Jamie Foxx or Ben Affleck promoting a large sports betting company. And on social media, sports betting giants are turning to influencers on those platforms.

Yet, in the rest of the world, companies that provide gambling information, tips and gambling news are the main drivers of revenue to sportsbook. Those companies, known as affiliates, promote businesses in return for either a share of the revenue a client generates who signs up from their website or via referral or they receive a set cost per new player acquisition.

Which is really better?

The speakers acknowledged that celebrities had a better reach and appealed to many in the general public who may not usually bet on sports, but influencers are costly and unless they are directly involved in the business, they may not provide much influence to people already betting on sports. Unlike poker, where a professional poker player’s endorsement would be very influential, many sports bettors may not care that Jamie Foxx or Allen Iverson endorses a sportsbook. On the other hand, affiliates are directly involved in the business, so anyone using their services is automatically a sports bettor or are interested in learning about sports betting. Consequently, affiliate sites are attracting actual bettors.

The one issue that all sportsbooks agree to with regards to affiliates is there is no consistency in the U.S. and Ontario. In some states like New Jersey an affiliate must be licensed. In states like New York there is no licensing required to be an affiliate. And in Ontario, the same rules apply to promoting sportsbooks on their sites as the companies face themselves, so an affiliate can’t promote a sports betting site if that includes the mention of bonuses or promotions. Once a consistent, or at least known, set of rules is set up and once influencers have run their course, affiliate usage will likely increase.

7. Companies are preparing for legal casino gambling, even in states where no law is being considered

In New Jersey and Pennsylvania, the online casino revenue and profits have far surpassed sports betting with most of the revenue coming from online slots. Yet the only states with online casino bills on the table are Indiana, Illinois, Kentucky, Louisiana, Massachusetts, New Hampshire and New York. And most analysts feel that the only states that likely will pass online casino gambling legislation in the near future are Indiana and New York. New Hampshire will almost certainly be limited to the lottery operator and the other states have far too much infighting to pass anything soon. The biggest reasons states are reluctant to offer online casinos is fear of cannibalizing land-based, as well as compacts they signed with Tribes who have exclusive rights to casino revenue in the state. And unsurprisingly most tribes are reluctant to release that monopoly to the states. Moreover, the Indian Gaming Regulatory Act (IGRA) precludes most Tribes from offering online gambling from the Tribal lands nor can they operate off Tribal lands without the state rewriting its constitution. Florida found that out recently when the federal government stopped the Seminole Tribe from offering online gambling, saying it violated the law. Only Michigan allows online gambling off Tribal lands because of a state law passed in 2019 that allowed both commercial casinos and Tribes to offer their products anywhere in the state and because bets are not being handled on Tribal lands, they are not subject to the IGRA. It doesn't appear any other state is anxious to follow Michigan’s lead.

The biggest reasons states are reluctant to offer online casinos is fear of cannibalizing land-based, as well as compacts they signed with Tribes who have exclusive rights to casino revenue in the state. And unsurprisingly most tribes are reluctant to release that monopoly to the states. Moreover, the Indian Gaming Regulatory Act (IGRA) precludes most Tribes from offering online gambling from the Tribal lands nor can they operate off Tribal lands without the state rewriting its constitution. Florida found that out recently when the federal government stopped the Seminole Tribe from offering online gambling, saying it violated the law. Only Michigan allows online gambling off Tribal lands because of a state law passed in 2019 that allowed both commercial casinos and Tribes to offer their products anywhere in the state and because bets are not being handled on Tribal lands, they are not subject to the IGRA. It doesn't appear any other state is anxious to follow Michigan’s lead.

Many sports betting, poker and casino companies decided to offer play-for-free sites as a way of enticing people, even in states that didn’t legalize it. Several companies had .net play for free sites in Michigan and Connecticut before it was licensed and in Ontario, Mohegan Sun offered a free-to-play app called Play Fallsview, where anyone could play all the latest slots with no restrictions. Mohegan Sun plans to flip that app into a real money app soon and because of all the customers who signed up for the free app, they now have a potential starting customer base. Consequently, the current sports betting companies are trying to decide if they should prepare to offer online casino wagering should things change.

The CEO of a major sportsbook told me that they don't want to throw good money after bad if there is no chance a state will allow for online casino wagering, but they also don’t want to be caught with their pants down if a state changes its law. It seems most sports betting companies are taking this on a state-by-state basis and the largest sportsbooks are setting up infrastructure and possible play-for-free casino apps and websites New York, Illinois, Louisiana and Indiana, since they are the most likely to legalize casino wagering. Plus, those states don’t have the Tribal issues for casino wagering that states like California, Wisconsin and Arizona do. Their populations also dictate that if casino wagering were allowed, the sportsbooks would benefit greatly by being ready to simply "flip a switch" as Mohegan Sun will in Ontario.

8. Legal California sports betting in the next year is 50-50 at best

Much of the North America Gambling Summit was focused on New Jersey, New York and Ontario, but there were discussions about other states, primarily in the sessions on Tribal gaming. The question of California came up and the consensus seemed to be that the legalization of sports betting in California in the next year is 50-50 at best. There are two propositions on the table for sports betting and voters will decide in the midterm elections whether either should be enacted. Proposition 26 would allow sports betting at four specified racetracks, with the Tribes in total control of the wagering. The Tribes would retain the revenue under that proposition and pay a percentage to the states. Proposition 27 would allow current sports betting companies that are licensed in at least 10 other states to offer online sports betting. This would allow companies like FanDuel, DraftKings, BetMGM and BetCaesars to apply for a license, but the cost of doing so could be astronomical. Speculation is that Tribes are opposed to proposition 27, but if the population does vote for it, Tribes may demand up to $100 million each to operate in the state. At the very least the Tribes will demand an amount that will make the sports betting companies blink. At $100 million there is little, if any, money to be made, even in a state that has the population of California and as many sports teams as it does. And, on top of the astronomical licensing fee, the state could demand a tax rate like New York.

There are two propositions on the table for sports betting and voters will decide in the midterm elections whether either should be enacted. Proposition 26 would allow sports betting at four specified racetracks, with the Tribes in total control of the wagering. The Tribes would retain the revenue under that proposition and pay a percentage to the states. Proposition 27 would allow current sports betting companies that are licensed in at least 10 other states to offer online sports betting. This would allow companies like FanDuel, DraftKings, BetMGM and BetCaesars to apply for a license, but the cost of doing so could be astronomical. Speculation is that Tribes are opposed to proposition 27, but if the population does vote for it, Tribes may demand up to $100 million each to operate in the state. At the very least the Tribes will demand an amount that will make the sports betting companies blink. At $100 million there is little, if any, money to be made, even in a state that has the population of California and as many sports teams as it does. And, on top of the astronomical licensing fee, the state could demand a tax rate like New York.

In either case, if voters do approve Proposition 26 or 27, the Tribes have made it clear that online casino gambling is completely off limits. Under no circumstances will they give up their monopoly on casino gambling in the state. That being the case, polls suggest that most Californians are split on sports betting, but it is uncertain if any of the big players can justify the cost of a license there, especially knowing that they will be limited to sports betting only.

9. DFS is no longer seen as a money maker

One of the last sessions of the conference was called “Fantasy is more fun – from revenue generator to experience differentiator” and featured panelists from FanDuel, Underdog Fantasy, Thrive Fantasy and Prize Picks. The session was quick to acknowledge that DFS was not the big money maker that FanDuel, DraftKings and even Yahoo Fantasy Sports hoped it would be, but it still serves a useful purpose in helping people learn about the sports betting industry. The panelists seemed to suggest that DFS has a role in creating an opportunity for a huge payout with little investment and more importantly teaches customers about players and sports in general - plus it is fun, particularly for fantasy contests that expand over a longer time.

All the speakers in the session said that they got their start in sports betting via DFS since it was legalized in the United States long before sports betting, and almost all to a tee said that they learned more about the players and games from playing DFS than they could have by simply watching the games. Consequently, the companies feel there is still a market for DFS in the United States, but the approach they take will need to be slightly different than the current offerings of FanDuel and DraftKings. Underdog Fantasy, for example has best ball competitions, plus they, along with Thrive Fantasy and Por Picks, have year-long competitions, which were popular with sports bettors long before DFS was even on the radar, although then they were known as rotisserie leagues. FanDuel and DraftKings only offer daily fantasy sports. Prize Picks and Thrive Fantasy also have unique fantasy contests and, along with Underdog Fantasy, are happy to cater to a few thousand devoted fantasy players in fewer contests, compared to FanDuel and DraftKings which still rely on volume to be successful. The speakers also acknowledged that DraftKings’ decision to take a chance offering single game showdowns and non-team sports helped build interest in fantasy sports, since some individual sports, like golf and auto racing, are among the most played options on the fantasy sites.

Underdog Fantasy, for example has best ball competitions, plus they, along with Thrive Fantasy and Por Picks, have year-long competitions, which were popular with sports bettors long before DFS was even on the radar, although then they were known as rotisserie leagues. FanDuel and DraftKings only offer daily fantasy sports. Prize Picks and Thrive Fantasy also have unique fantasy contests and, along with Underdog Fantasy, are happy to cater to a few thousand devoted fantasy players in fewer contests, compared to FanDuel and DraftKings which still rely on volume to be successful. The speakers also acknowledged that DraftKings’ decision to take a chance offering single game showdowns and non-team sports helped build interest in fantasy sports, since some individual sports, like golf and auto racing, are among the most played options on the fantasy sites.

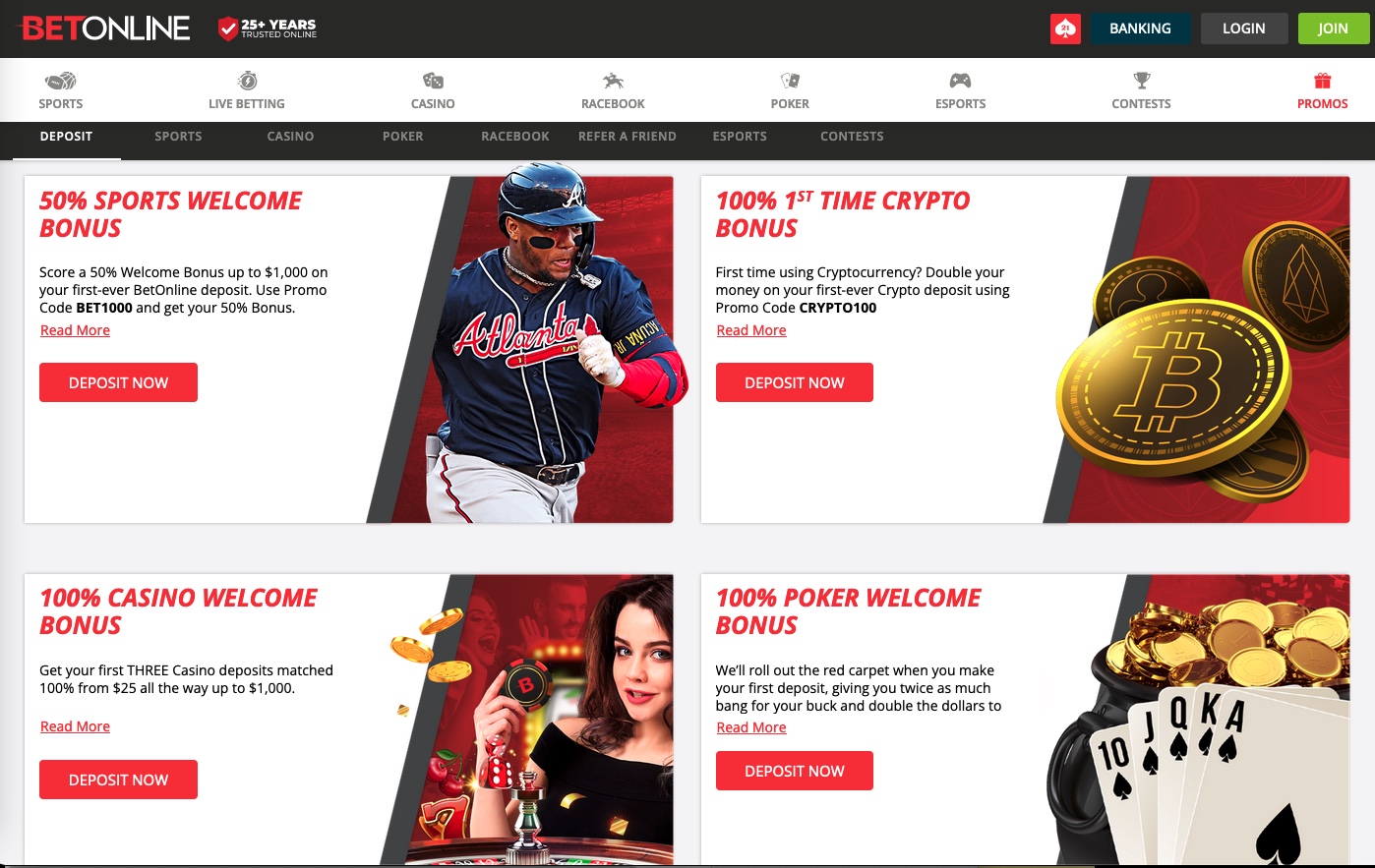

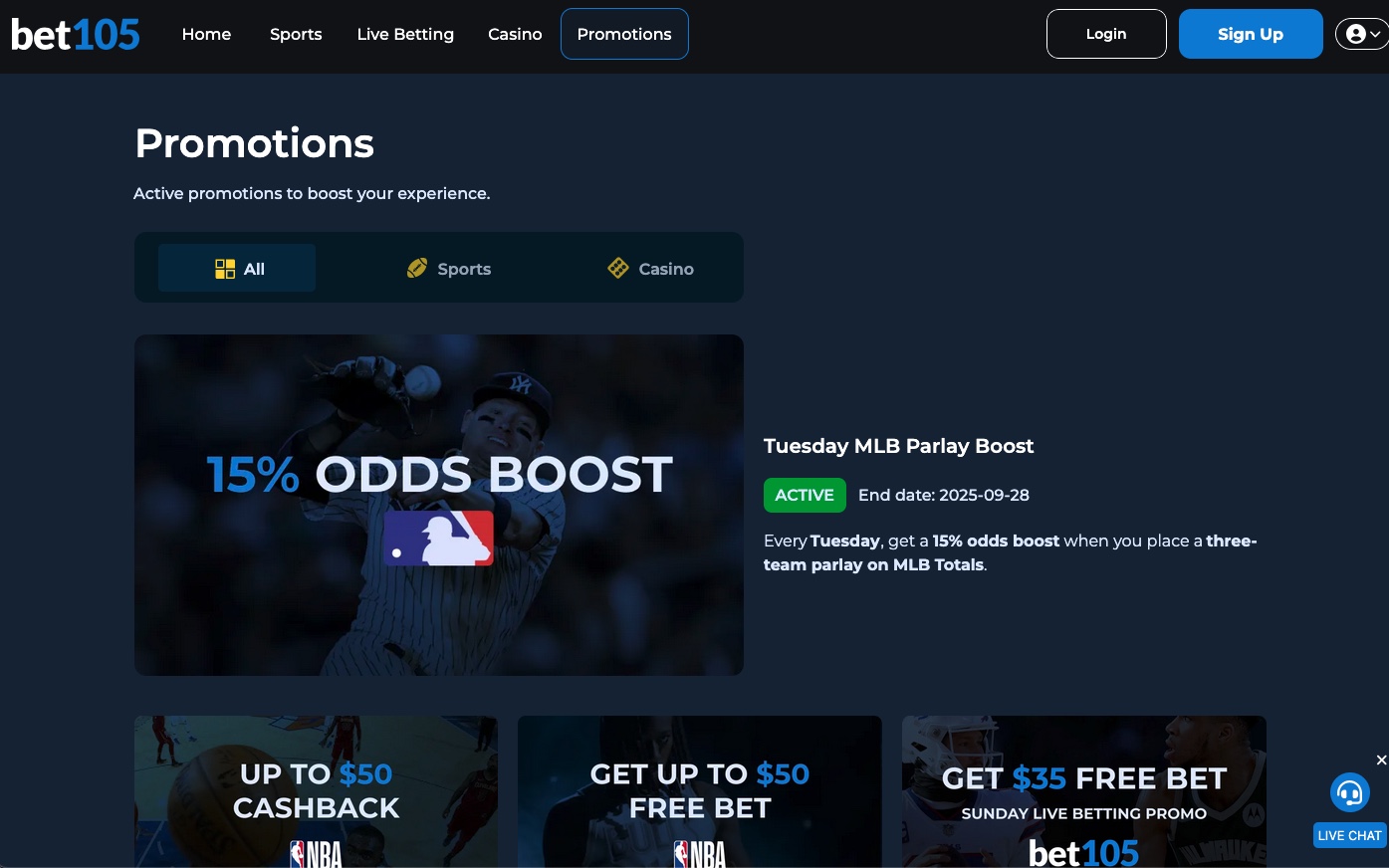

10. Licensed and regulated sportsbooks are angry that not enough is being done about offshore operators

One of the most talked about sessions at the conference was by Amy Howe, the CEO of FanDuel, who said that offshore sportsbooks were operating with an unfair advantage because they didn’t pay tax and then stunned many when she claimed that 25% of offshore players will never be paid out by offshore books. This created a lot of ire on Twitter by sports bettors who claimed that isn't true with some claiming she was just angry that FanDuel is paying up to 51% tax when they pay nothing.

I’m not sure what is worse: the fact that she actually believes this or that she chose to say it out loud? Either way it seems like it’s certainly time for a new PR person for these CEO’s who continue to say absurdly outrageous things.

— Jeffrey Benson (@JeffreyBenson12) July 19, 2022

Almost all bettors said they get paid and the days of scam books like Ace’s Gold, Top Turf and Camelot Bets were long behind us. Nevertheless, FanDuel, along with the other major players in the sports betting business petitioned the AGA to do something about offshore gaming and the AGA did just that by sending a letter to Attorney General Merrick Garland and the DOJ asking them to take a harder stance to stop offshore operations from catering to U.S. citizens.

I asked one of the legislators at the conference if it was even possible to arrest offshore operators and he said that unless the offshore companies operated in a jurisdiction that had an extradition treaty with the U.S. or if management at the site was dumb enough to step foot in the U.S., as David Carruthers did almost 15 years ago, that they probably could do little about it. But the legislator added that it was worth at least trying to let the operators know they were being watched. I also asked if the U.S. was shooting itself in the foot by not taking Ontario’s approach and waving the bad actor clause with the intent that offshore books would get licensed and pay taxes and licensing fees like all the current books, but he just laughed and said that was a "non-starter."

I also asked Paul Burns, the CEO of the Canadian Gaming Association, if he was prepared to take actions similar to the AGA in Ontario once the six month grace period had passed and petition the Ontario Attorney General to go after the offshore books who are continuing to operate without receiving an Ontario license. He also acknowledged that there is little Ontario can do other than to let gamblers know they are betting illegally and without consumer protection if they continue to play at those sites. He did say that he will see what plays out in October or November since that will be the end of the 6 month grace period that the government gave the offshore companies to stop operating illegally and apply for a legal Ontario license.

Looking for more from the SBC Summit North America gambling conference? Click here to get more insights and commentary on the 2022 conference in Part 1 of this series.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!