The use of cryptocurrency may have saved offshore gambling

After the passage of the Unlawful Internet Gambling Enforcement Act (UIGEA), offshore gambling sites that catered to the U.S. market started realizing the difficulty of receiving and sending payments to American bettors. Some banks had blocked credit card payments to gambling sites for several years prior to the UIGEA, although some did process them and there were other options such as Western Union and NETeller. The e-wallet solution allowed bettors and gambling companies to transfer funds back and forth with the gambling sites charged a very small fee per transaction, and gamblers could even send transfers to each other for a 1.9% fee using NETeller.

Before BTC there was NETeller

NETeller was seeing millions of dollars moved daily for betting purposes and the best part for gamblers is that it was all anonymous.  That all changed in 2007, a few months after the passage of the UIGEA when the FBI arrested NETeller founders Stephen Lawrence and John Lefevre in the U.S. Virgin Islands and Malibu, California respectively. The FBI then seized all funds in transit to American banks and the following day NETeller management cut off U.S. customers and any funds owing to U.S. customers were held hostage. A month later they also blocked Canadian customers who were often helping Americans get their funds out of NETeller. A few months later the DOJ worked out a deal to allow American customers to retrieve their funds from NETeller by supplying information to the DOJ which most American gamblers did, although some larger gamblers chose to forfeit the funds believing they would be on a watch list and possibly face an IRS audit.

That all changed in 2007, a few months after the passage of the UIGEA when the FBI arrested NETeller founders Stephen Lawrence and John Lefevre in the U.S. Virgin Islands and Malibu, California respectively. The FBI then seized all funds in transit to American banks and the following day NETeller management cut off U.S. customers and any funds owing to U.S. customers were held hostage. A month later they also blocked Canadian customers who were often helping Americans get their funds out of NETeller. A few months later the DOJ worked out a deal to allow American customers to retrieve their funds from NETeller by supplying information to the DOJ which most American gamblers did, although some larger gamblers chose to forfeit the funds believing they would be on a watch list and possibly face an IRS audit.

The loss of NETeller as a payment solution created a dilemma for most offshore sites. They could not use bank wires from U.S. banks for transfers since most banks refused to process them due to the UIGEA restrictions, they had no e-wallet solutions and money transfers from Western Union and MoneyGram were smaller transactions that were often hit or miss. Most offshore gambling sites had to turn to creative solutions such as money transfers to individuals rather than the company itself, credit card deposits to legitimate looking businesses like book sellers and taking personal checks made out to individuals that could not be identified as gambling site management. And for some companies, like WSEX which eventually went under, they were being monitored like a hawk and eventually had no way to receive or send money. That led to a cash flow issue and their eventual demise. Some sites like Pinnacle and The Greek decided that due to scrutiny by the American government and the hassle of trying to get payments to and from Americans, that they would leave the U.S. market around 2010-2011 and try to survive by catering to the rest of the world where there were no restrictions in place. It seems to have worked for Pinnacle Sports, which still operates in Europe and Canada, but the Greek could not make a go of it without U.S. customers and closed down its operations in 2019, less than 8 years after leaving the U.S. market.

Hello Bitcoin!

Things looked dire for offshore books catering to the U.S. market until 2009 when an unknown person identified as Satoshi Nakamoto created something called Bitcoin (BTC). Bitcoins were mined using computer software with all transactions put on an open ledger called a blockchain. Few people really understood how blockchains worked and bitcoins had virtually no value until 2011 when Bitpay was developed and the cryptocurrency started being used by criminals as a payment method. Because transactions were anonymous and presumed untraceable criminals started accepting BTC for payments.  A company called Silk Road, which worked on the dark web provided narcotics, guns, various other forms of contraband, even allegedly arranged hit men in exchange for bitcoins. This caused the price of bitcoins to surge in 2012 to almost $20 each before coming back down to the $3-$6 level which was the norm in late 2011 and 2012.

A company called Silk Road, which worked on the dark web provided narcotics, guns, various other forms of contraband, even allegedly arranged hit men in exchange for bitcoins. This caused the price of bitcoins to surge in 2012 to almost $20 each before coming back down to the $3-$6 level which was the norm in late 2011 and 2012.

Bitcoins were featured on an episode of The Good Wife in 2012, which led to people looking into it and the price rose steadily. It rose even more after the Silk Road founders were discovered, arrested and the site shut down. But the biggest event that led to Bitcoin’s new acceptance as a payment method was Elon Musk agreeing to accept BTC as payment for Tesla vehicles. The price went well above $200 each and never retreated. Today BTC are worth nearly $30,000 each and peaked at just over $67,000 per coin in November 2021, as many investors were looking for an alternative to fiat following the delta wave of Covid. All of a sudden, people who mined or traded these BTC and were sitting on hundreds or thousands of them they obtained for next to nothing were multi millionaires. In fact, it is estimated that the number of bitcoin billionaires in the United States in 2022 was in the hundreds. There were many snafus along the way, including the Mt. Gox theft, the QuadrigaCX scam and the failure of various BTC exchanges, but that is beyond the scope of this article.

Bitcoin for gambling

Some BTC betting sites were set up in 2010 and 2011, including Satoshi Dice, BTC Sportsbook and a few others, but they only allowed betting by BTC and the stakes were small since at the time BTC was virtually worthless. It wasn’t until late 2011 that Switch Poker, a mainstream poker site, set up a facility that allowed poker players to deposit funds with BTC, convert them to U.S. dollars, play with those funds and then withdraw any winnings back to their BTC wallets. It appears at that point that many of the offshore sites realized that this was a potential solution to the issue of deposits and withdrawals.

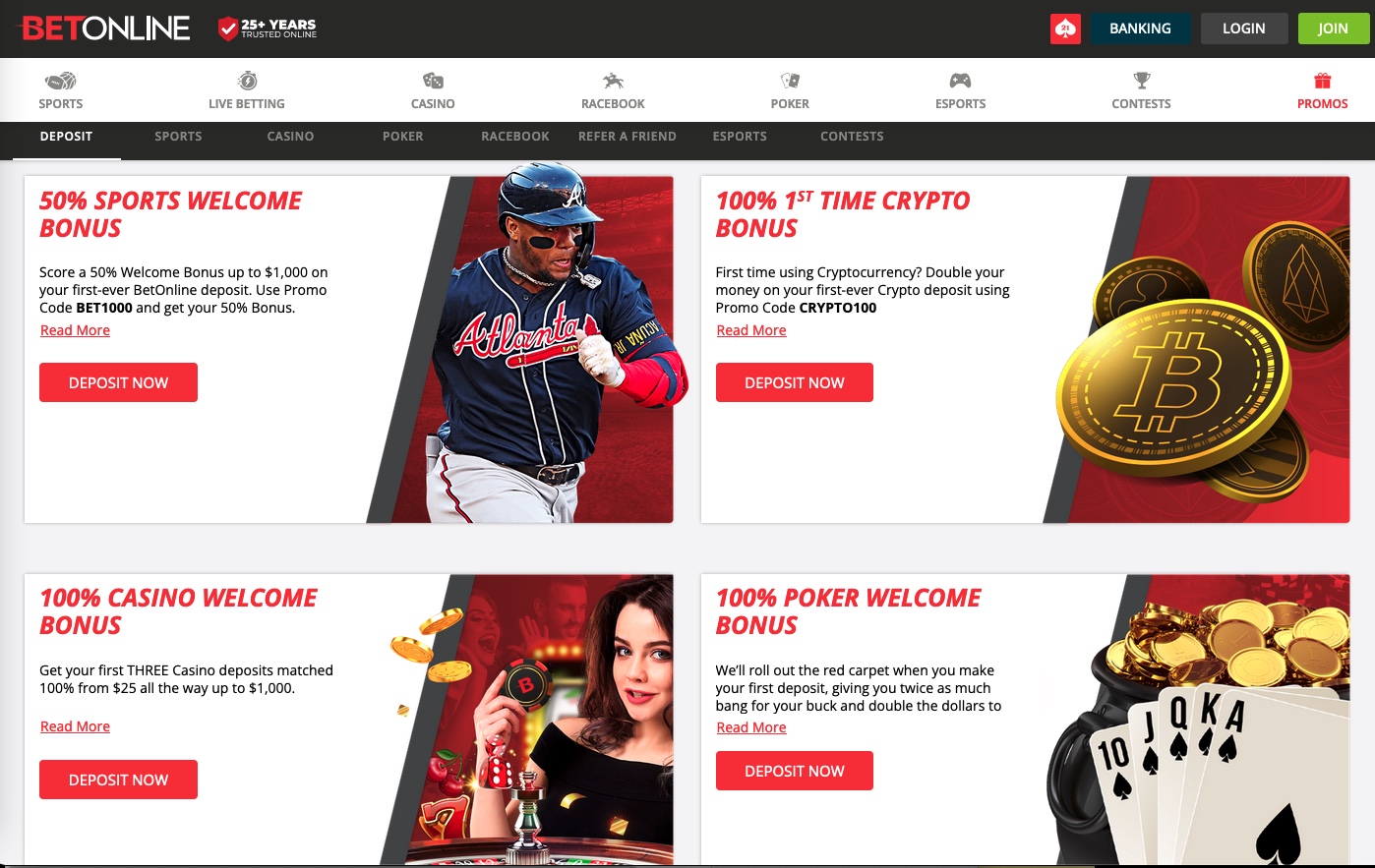

It is believed that 5Dimes was the first sportsbook to accept BTC as payment and they operated in the same way as Switch Poker, i.e., deposits are made by BTC, converted to USD, played as USD and any withdrawals are converted back to BTC at the listed rate on exchanges like Coinbase and sent back to the player. Other sites like Heritage Sports, BetOnline, Bodog (now Bovada), and eventually all online gambling sites catering to North America started accepting BTC as a payment solution. The huge fluctuations in the price of BTC was a concern but Tony Creighton, the CEO of 5Dimes created its own exchanges so that they could monitor the price and ensure they were not out too much fiat currency if the price went up or down too fast. Unfortunately for Creighton and his family, the knowledge that he had millions of dollars worth of Bitcoin at 5Dimes led to his kidnapping, ransom request and eventual murder at the hand of Costa Rican criminals. It is also believed that had WSEX been able to hang on for 2 or 3 more years they would still be operational and profitable by utilizing cryptocurrency as payment options. Other sites, including Heritage, followed 5Dimes lead and set up their own crypto exchanges.

Use of Altcoins

Bitcoin’s popularity led to other companies creating their own form of cryptocurrency, each with its own listed purpose and method of creation and mining. The first non-BTC cryptocurrencies, which became known as Altcoins, were Litecoin (LTC), Namecoin (NMC) and Ethereum (ETH).  They all have different processing fees and run their own blockchain and they are also slightly different in that BTC is a form of decentralized currency whereas most Altcoins, like ETH, are networks that allows decentralized applications to create smart contracts. Other Altcoins are also just tokens or NFTs, although in the end they are still just digital codes. Regardless, they all have some value that allows them to be sold on exchanges and converted to USD and other fiat currencies, so many of the gambling sites accept them as payment. Coinmarketcap.com indicates there are about 23,000 different cryptocurrencies out there and BetOnline accepts payment by BTC and 15 different altcoins (ETH, LTC, XRP, USDC, ADA, USDT, XLM, DOGE, MATIC, SHIB, AVAX, SOL, BNB, BCH and TRX). No fees associated with any of them and the full value off the deposit is converted to USD for usage.

They all have different processing fees and run their own blockchain and they are also slightly different in that BTC is a form of decentralized currency whereas most Altcoins, like ETH, are networks that allows decentralized applications to create smart contracts. Other Altcoins are also just tokens or NFTs, although in the end they are still just digital codes. Regardless, they all have some value that allows them to be sold on exchanges and converted to USD and other fiat currencies, so many of the gambling sites accept them as payment. Coinmarketcap.com indicates there are about 23,000 different cryptocurrencies out there and BetOnline accepts payment by BTC and 15 different altcoins (ETH, LTC, XRP, USDC, ADA, USDT, XLM, DOGE, MATIC, SHIB, AVAX, SOL, BNB, BCH and TRX). No fees associated with any of them and the full value off the deposit is converted to USD for usage.

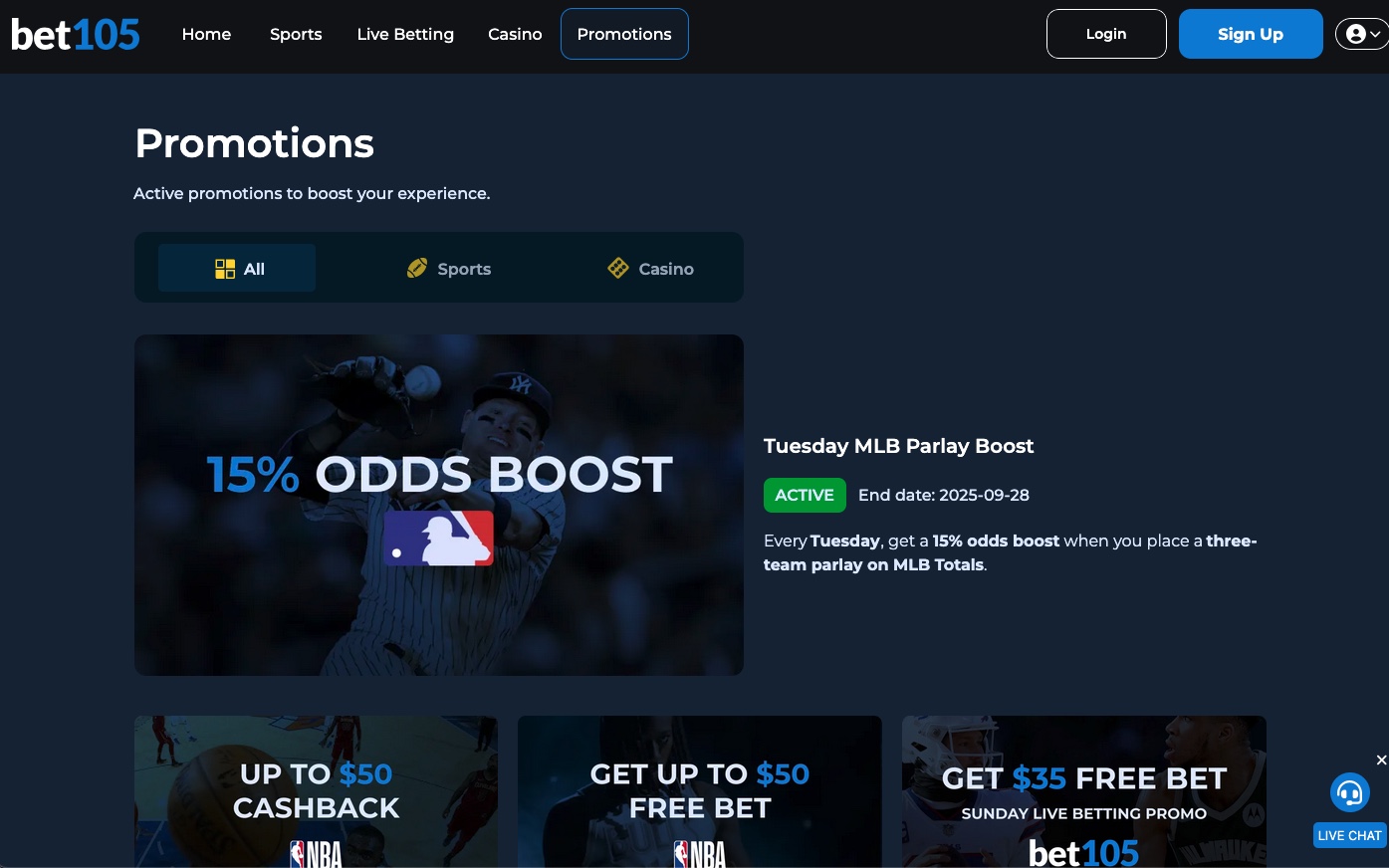

BetOnline, Heritage Sports, Bovada and others prefer payments by cryptocurrency, even though they accept other forms of payment, and some will only allow payments by crypto for American customers. In fact, for non-Americans, these sites will generally offer bonuses for payments by cryptocurrency. The reason for that is obvious, they are fast, easy, can’t be intercepted by the DOJ or any governments and because the demand is so high can be easily converted to or from USD, Euros etc. without delay.

I spoke to someone at 5Dimes a few years back who told me that if it wasn’t for cryptocurrency, he had no doubt that 5D would have had no choice but to fold.

"We were wishing for a miracle to survive," the 5Dimes employee told me, "and we were given that wish with Bitcoin. When we were first told about it in 2011 and the opportunity it presented, we were all confused and skeptical. We were provided an explanation of the blockchain and I recall thinking it was stupid and unworkable. But as a group we figured we would give it a shot as we had nothing to lose. That decision saved us. Tony started learning more about blockchain technology, we hired on geeks to help us set up our exchange and soon we were the pioneers in crypto. I have no doubt it saved our business and it saved the industry."

5Dimes of course no longer operates, after Tony Creighton’s widow worked out a deal with the DOJ and returned to the U.S. They unsuccessfully tested the European market and are currently apparently seeking a license in the crowded Ontario market. It should be noted that if 5Dimes does get an Ontario license they will not be able to use any cryptocurrency, since all payments in Ontario have to made by CAD.

So, without question cryptocurrency saved the offshore industry from extinction, at least those that relied on American customers to survive. That alone makes cryptocurrency one of the biggest stories in OSGA history from the last 25 years.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!