Casinos could require digital currency transactions in the future

A topic of interest in the last year or so has been the research and development of Central Bank Digital Currency (CBDC) around the world. Founded on the principal of cryptocurrency such as bitcoin or Ethereum, CBDC is a digital currency that is issued by a country’s government, using their official fiat currency units, and would be fully accepted by any retailer the same way fiat currency is. Unlike cryptocurrency, however, CBDC are not mined and do not need to be authorized by internationally distributed networks of participants or put on a public ledger to be viable. Instead, CBDCs are only authorized by the central bank of a country or its affiliated financial institutions and the purpose is to remove the barriers surrounding the difficulties and issues surrounding the use of physical cash. It is also hoped that CDBCs will lift barriers for people who want to purchase items while dealing with foreign countries.

Most U.S. banks, for example, will not cash checks in Barbados dollars, and even when Barbados dollars are taken to a U.S. bank for exchange to U.S. dollars the bank will likely refuse to deal with it, since it is not a currency they are comfortable exchanging. The concern for most countries trading foreign cash and checks is the legitimacy and origins of the funds, the huge transaction fees involved in trading between banks and worries related to money laundering or illicit activities. Where a country is known to have strict regulations in place, like the United States, Canada, the UK, the EU or Australia, the banks will happily exchange the currency amongst each other because they can vow for the legitimacy of the funds and know the other country's central bank is backing the amounts deposited.

But with CDBCs, the thought is that central banks and tax authorities in any country would work together and can ensure anyone that is trading their currency in any country that the funds are legit. More importantly, the funds are debited immediately from a person’s digital wallet, so they don’t have to wait to see if the other bank will honor the transaction. There are even suggestions that all digital currency transactions could include the metadata used in creating the digital transaction to satisfy any concerns. This is why cryptocurrency transactions are so easy and efficient, regardless of where the person's digital wallet physically resides. CBDCs would also avoid the frustration of customers that use ATMs in foreign countries where limits are low, and fees are high (including exchange fees).

The huge rise in popularity with cryptocurrencies, such as bitcoin or Ethereum, is a concern for governments and banks who believe that without action, a large percentage of citizens will turn to crypto, which would drain the local economy that is built on funds in bank accounts. The hope by governments is that CBDCs will convince citizens that prefer digital options to keep their paychecks and savings at the banks rather than purchasing cryptocurrency. After all, crypto was designed as a hedge against fiat, which was often viewed as being propped up governments and banks and could lose value quickly due to inflation or bank fraud. But, if people could get the same benefits of cryptocurrency via a CBDC, they would likely consider using the local digital currency instead. There is also hope, that unlike cryptocurrency, which is prone to huge daily price fluctuations, CDBCs would remain stable.  Ideally, the method for using digital currency would be for individuals to have a funded digital wallet in something like digital U.S. dollars and when they want to purchase something, they would scan a QR code from a smartphone and the cost of the item would be debited from their digital wallet and deposited in the digital wallet of the retailer. The first CDBC was launched in December by the Bank of the Bahamas called the Sand Dollar. The following is the explanation of the purpose from the Sand Dollar website:

Ideally, the method for using digital currency would be for individuals to have a funded digital wallet in something like digital U.S. dollars and when they want to purchase something, they would scan a QR code from a smartphone and the cost of the item would be debited from their digital wallet and deposited in the digital wallet of the retailer. The first CDBC was launched in December by the Bank of the Bahamas called the Sand Dollar. The following is the explanation of the purpose from the Sand Dollar website:

Sand Dollar is the digital version of the Bahamian dollar (B$). Like cash, Sand Dollar is issued by the Central Bank of The Bahamas through authorised financial institutions (AFIs). Sand Dollar allows greater flexibility and accessibility for residents that want to participate in financial services via either a mobile phone application (iOS and Android) or using a physical payment card to access a digital wallet. It also provides an excellent record of income and spending, which can be used as supporting data for micro-loan applications.

According to reports up to eight in 10 countries are looking at CBDC and three countries, China, Sweden and the Ukraine have begun a pilot project to test digital currency which has been developed. China is expected to fully release the digital yuan at some point in the next year.

Macau may see only CBDC funding in the future

Once the digital yuan is fully implemented, there are reports that the Chinese government is going to demand that all casino chips in Macau casinos must be purchased using the digital cash (likely in a designated wallet), instead of the Hong Kong dollar that is the base currency now. Thus, the Chinese government can keep track of the casinos and junket operators, who they have accused of being wrought with corruption. It also allows the communist government to keep a close eye on bettors and other countries and enforce the ban currently in place on cross border payments from Chinese residents for gambling in countries like the Philippines, Singapore and Vietnam.  Currently, Chinese residents can only legally gamble in Macau. Junket operators believe VIP customers would be turned off using the digital currency and it will effectively be the death knell of the industry. In fact, one long time and popular junket operator, Eric Leong, has left the industry due to the inevitable use of the digital yuan in Macau, as well as the impact on casinos from COVID-19. Other junket operators are also reexamining their situation to see if there is a better use of their services in other industries, since the crackdown on gambling from the digital currency may make their businesses unviable.

Currently, Chinese residents can only legally gamble in Macau. Junket operators believe VIP customers would be turned off using the digital currency and it will effectively be the death knell of the industry. In fact, one long time and popular junket operator, Eric Leong, has left the industry due to the inevitable use of the digital yuan in Macau, as well as the impact on casinos from COVID-19. Other junket operators are also reexamining their situation to see if there is a better use of their services in other industries, since the crackdown on gambling from the digital currency may make their businesses unviable.

CBDCs still ahead in the U.S.

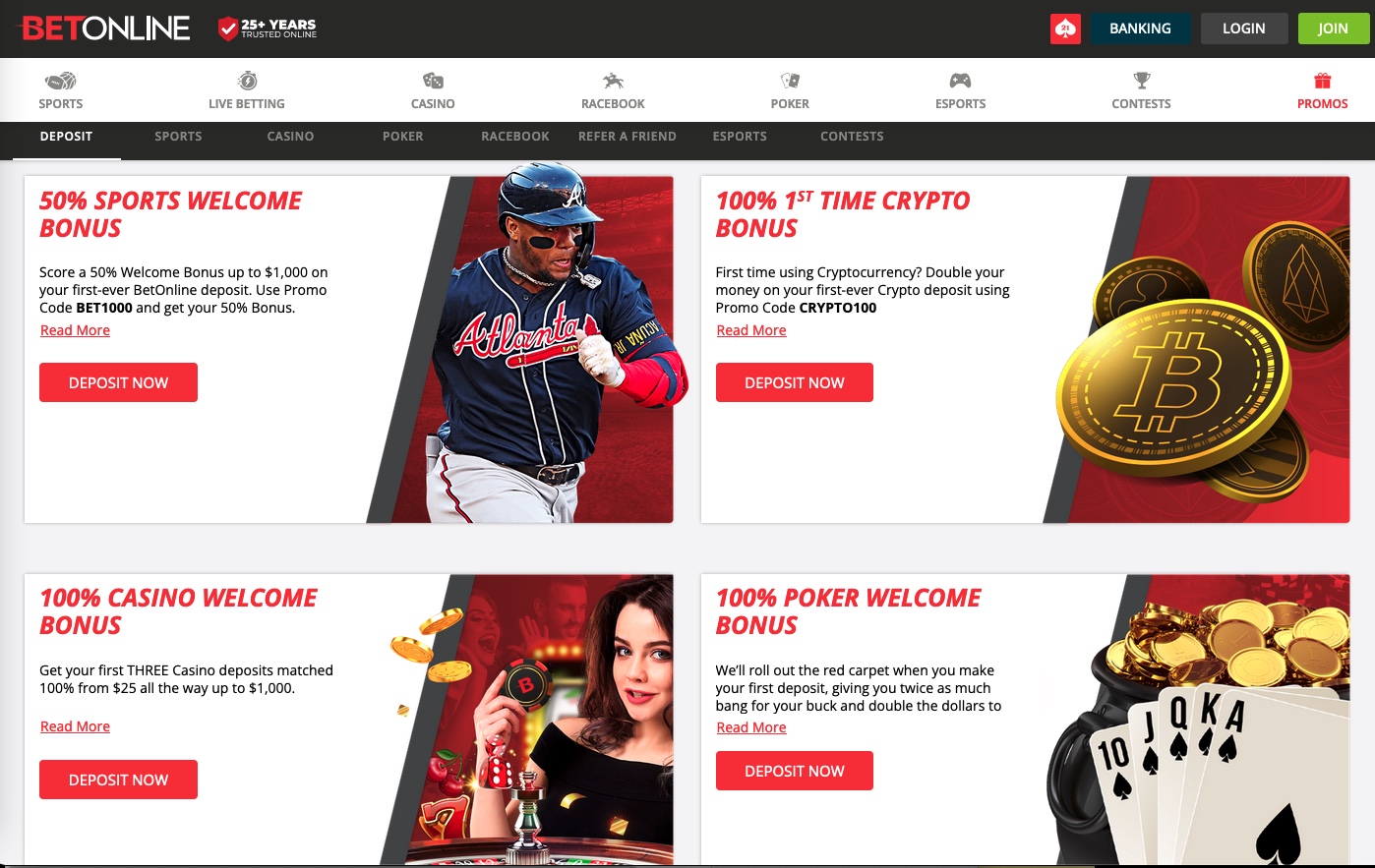

The United States is currently in the research stage of CBDCs, but there is a belief that if a digital U.S. dollar was ever developed, most casinos would also demand that chips be purchased with a digital wallet to eliminate the concerns about dirty and counterfeit money, which has been a burden on casinos in Nevada and other states since their inception. And the current situation with COVID-19 shows that many businesses, including casinos, are starting to prefer "contactless payments" as there is a fear of greenback dollars containing germs. In fact, many businesses throughout the world today will only accept payment by debit or credit cards or a funded app where staff doesn't have to touch any physical currency. And, while COVID-19 will eventually end, it is accepted that viruses and other pandemics will be a problem for the foreseeable future.

The use of a digital wallet also provides an added benefit to both the casinos and players, particularly in the United States, because any taxes can be deducted automatically at the source and any subsequent losses will have an audit trail to help customers fill in their tax returns at year end. At the same time, many old timers will likely mourn the days of old when someone would just throw down a pile of $100 bills on a table, the dealer would announce "playing to the limit", and almost immediately a pit boss would come over and ask the player if he needed any comps like a room for the night, a meal or tickets to a show.

Digital Concerns

One of the big concerns about any digital currency is hacking, corruption and stealing of the currency as happened at places like Mt. Gox, KUCoin and Lendf with bitcoin thefts. And many North American cryptocurrency buyers lost millions of dollars after QuadrigaCX founder Gerald Cotten used an illicit scam to effectively steal the post up currency of its clients and used it in a type of Ponzi scheme whereby, he never invested the money of its customers to buy any cryptocurrency and instead put it into a separate bank account. Speculation is that Cotton never truly believed in crypto and felt he would get rich when the cryptocurrencies went to nothing or alternatively would buy the crypto at a low point. His plan failed, however, when the price of crypto skyrocketed almost immediately after starting Quadrigacx. The company was shut down and declared bankrupt after Cotton apparently had a medical episode in India and died with all the codes of the offline wallets where the funds were stored.

Consequently, for the public to buy into the use of CBDCs in North America, they will likely want proof that their digital wallets are secure and safe from any hacking. They also will not agree to the anonymity and security measures that are associated with current cryptocurrencies, such as a requirement that wallets can only be accessed via a password and if that password is forgotten the currency is gone forever, or the rule that an account can only be retrieved from a 12 word code randomly generated when a wallet is created. Two-step verification will not be a concern, but the chance that funds could magically go “poof” will never be agreed to by customers. The fact that lawsuits are being considered against companies like Coinbase and Metamask that have the crypto of customers in wallets that customers have no possible way of retrieving them since they can’t remember passwords, or 12-word phrases, is proof of that.

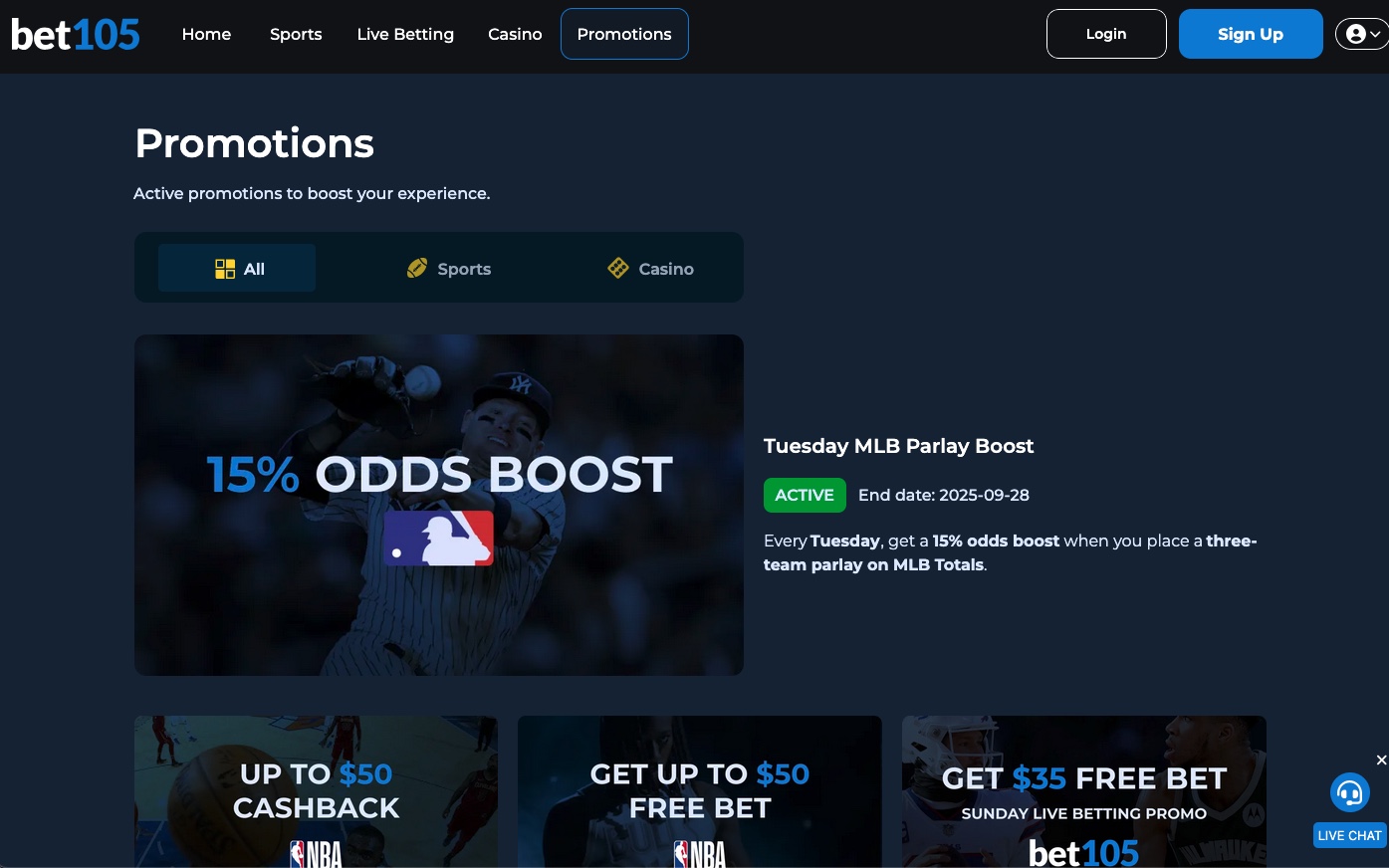

So, it seems only a matter of time before most countries have a digital form of their fiat currency which becomes the norm for daily transactions. This will almost certainly have a major impact on the gambling industry, which would more than likely be forced to accept transactions only by the digital currency and it could also have an impact on current cryptocurrencies which could lose popularity if there is a national alternative. Offshore gambling sites have seen that firsthand, as play by American customers declined dramatically after states legalized sports betting and online casinos. And, if national digital currencies are developed, it is very likely that governments around the world will try and cut down on cryptocurrencies that they will view as unwanted competition. How that will work is uncertain, but China has already implemented a law that makes it illegal for banks to process any transactions from crypto exchanges like Kraken and they could make it a federal crime for Chinese companies to accept payments by bitcoin or other cryptocurrencies. And while the U.S. is not a communist country, it must be remembered that the FBI started seizing websites and arresting owners of offshore websites who they deemed were operating a business that went against the public good. Consequently, bitcoin could go to $250,000 as some analysts have discussed or it could go to zero if it is deemed illegal and a rogue currency that threatens a country's CBDC, as happened in its early days when bitcoin was used to fund the contraband website Silk Road.

Several gambling stocks with ties to Macau are down with the talk of CDBC-only transactions and it warrants keeping a close eye on the future of Digital Currency and how it will transform casino gambling.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!