While online gambling companies are experiencing tough times in all jurisdictions the one company that continues to thrive is Betfair. In fiscal 2015 Betfair recorded a 32% increase in earnings and 53% increase in operating profit. They had gains in all streams they offer and, had the UKGC point of consumption tax not been applied in December 2014, the figures would have been even higher. While the majority of Betfair's action has comes from Europe and predominantly the UK and Ireland, Betfair has seen increases in all jurisdictions it operates in, including the United States.

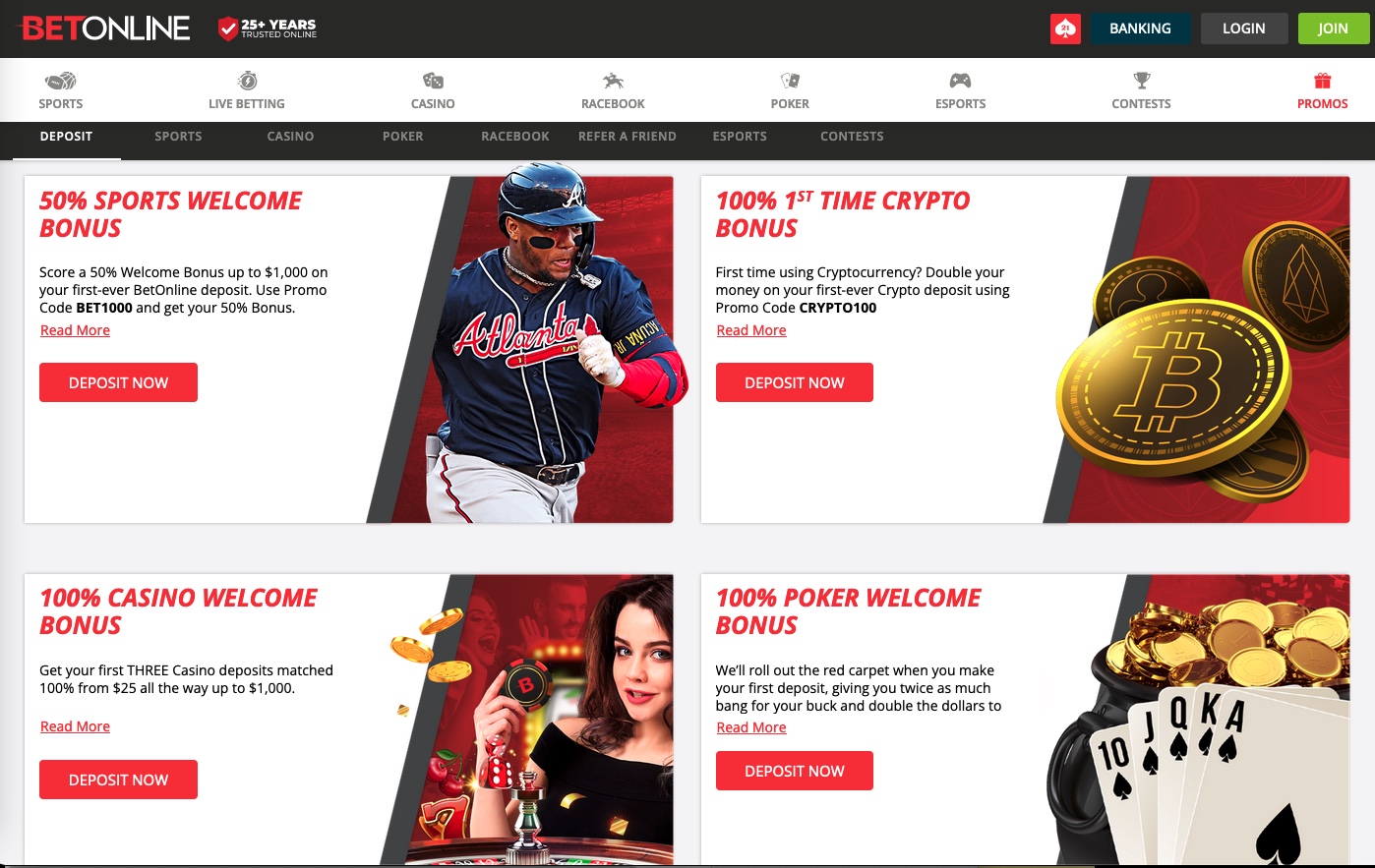

In the U.S. Betfair's operations are limited to horse racing and an online casino in New Jersey but the results have been impressive. The TVG horse racing network it purchased in 2008 saw an increase in revenue over 20% and the partnership with Golden Nugget in New Jersey has been surprisingly successful. Betfair's original partnership with Trump Plaza in New Jersey turned out to be a dud and it appeared Betfair would be leaving New Jersey after Trump Plaza clos ed shop in mid-2014. But Golden Nugget decided to take a shot on Betfair as a partner in September 2014 to see if it could push the company past the top 3 in the state (Borgata, Tropicana and Caesars) in terms of iGaming revenue. Golden Nugget took advantage of Betfair's expertise in the area of customer acquisition and advertising and by March 2015 they were ahead of several other companies in iGaming revenue in New Jersey. In fact Golden Nugget is the only company to post $3 million in monthly revenue and has almost 1/3 of the non-poker online market in the state and Golden Nugget's online revenue is equal to the land based revenue and is expected to exceed it within the next year. The New Jersey Division of Gaming Enforcement indicated in that Internet gaming rose 23 per cent to $11.7m in June, with the Golden Nugget again posting the biggest year-on-year growth. The company runs both Goldennuggetcasino.com and Betfaircasino.com.

ed shop in mid-2014. But Golden Nugget decided to take a shot on Betfair as a partner in September 2014 to see if it could push the company past the top 3 in the state (Borgata, Tropicana and Caesars) in terms of iGaming revenue. Golden Nugget took advantage of Betfair's expertise in the area of customer acquisition and advertising and by March 2015 they were ahead of several other companies in iGaming revenue in New Jersey. In fact Golden Nugget is the only company to post $3 million in monthly revenue and has almost 1/3 of the non-poker online market in the state and Golden Nugget's online revenue is equal to the land based revenue and is expected to exceed it within the next year. The New Jersey Division of Gaming Enforcement indicated in that Internet gaming rose 23 per cent to $11.7m in June, with the Golden Nugget again posting the biggest year-on-year growth. The company runs both Goldennuggetcasino.com and Betfaircasino.com.

There's no question that whatever Betfair touches seems to turn to gold lately, but that wasn't always the case. Betfair was founded in 2000 by Andrew Black and Ed Wray offering its unique form of exchange wagering where players could bet on teams, horses or individuals to win or lose. Betfair posted markets, but players set the odds. So for every individual that took one side of the bet, another individual took the other side. Consequently, Betfair was a middleman that took a commission on winning wagers. Unlike traditional bookmakers, which usually had an interest one way or the other since balancing the books traditionally is virtually impossible, Betfair never had an interest since unmatched offers just expired. The market also ensured there was no built in vig or juice. The only cost to the bettors was the commission. Betfair became a mainstay for customers who believed they had a system for beating the exchange; for customers who liked the option to hedge bets; and for traditional bookmakers which used Betfair to help lay off some of the action they received at their sportsbooks. In fact, one of the most successful sportsbooks indicated to me privately that they never held more than $10,000 on any bet and anything over and above that they laid off at Betfair!

As a result of its success Betfair decided to go public on the FTSE exchange. The IPO traded at £13 (£ is Great Britain Pounds) but quickly went downhill from there. While the company was always profitable, earnings were slow and in August 2011 Betfair's stock hit a low of less than £6. As a result of the mediocre performance the CEO at the time David Yu resigned and in August 2012 the company hired Breon Corcoran from Paddy Power to take over CEO duties. Corcoran made several decisions including introducing a traditional fixed odds sportsbook, offering a cash out option on both the betting exchange and the sportsbook whereby betters could cash out their bets at the current odds and use that money immediately, and a price rush option on horse racing whereby for certain bets, gamblers were giving better odds than those quoted in the sportsbook by putting that bet into the exchange. Betfair also introduced numerous promotions on the sportsbook and cross promotions between the sportsbook and casino whereby if you made a wager on one you could get a free bet on the other. While the sportsbook has grown dramatically, the exchange has remained fairly stagnant, although the two streams complement each other well and provide different options for bettors.

Corcoran's biggest move which helped spur growth, however, was reducing staff and exiting grey markets. In early 2013 CVC Capital Partners issued a £950 million hostile takeover bid for the company but Betfair Chairman Gerald Corbett along with Corcoran were able to convince shareholders that the offer undervalued the company and were able to stave off the takeover by increasing profits via job cutting. Betfair cut 500 jobs reducing the staff from almost 2,300 to 1,800 mostly from jobs they deemed were redundant and by cutting management positions in countries they no longer wanted to focus on. In the same light they decided to exit countries they decided were not worth trying to fight battles with such as Germany, Spain, Cyprus, Portugal and Greece, which they felt had regulatory and tax hurdles that were too high to make them profitable in the long run. Ironically despite leaving Germany, Betfair was one of the 20 companies that has been given an online sports betting license under a new program that Betfair deems is more realistic and many believe one of the reasons they received that license is that they left grey markets such as Germany, thereby giving them a clean slate.

As a result of the moves Betfair saw its customer base expand by almost 50 percent resulting in revenue and profits skyrocketing and leaving the company with well over 250 million in cash. Moreover the share price has risen to well over £20 and consequently the board decided to reward the shareholders who they deemed as patient and loyal since the company went public by returning over £200 million in cash back to the shareholders and increasing the dividend. Betfair has also doubled Ladbrokes in terms of revenue leading Ladbrokes to look for a new CEO. And CVC Capital Partners bought out Skybet for £800 million after failing to acquire the company they really wanted.

As a result of the moves Betfair saw its customer base expand by almost 50 percent resulting in revenue and profits skyrocketing and leaving the company with well over 250 million in cash. Moreover the share price has risen to well over £20 and consequently the board decided to reward the shareholders who they deemed as patient and loyal since the company went public by returning over £200 million in cash back to the shareholders and increasing the dividend. Betfair has also doubled Ladbrokes in terms of revenue leading Ladbrokes to look for a new CEO. And CVC Capital Partners bought out Skybet for £800 million after failing to acquire the company they really wanted.

Just to show how unusually successful Betfair has been compared to other online gambling companies, Ladbrokes saw profits decline by 60% in its fiscal year and the share price for that company has dropped to just under £1.1 at the time of writing. In mid-2013 when Betfair was just starting its turnaround Ladbrokes was trading at a high of almost £2.5. Similarly William Hill which has a sportsbook operation in Nevada, as well as its worldwide operation, has announced poor results of late, although it hasn't negatively affected the stock price. At last writing William Hill's stock was trading at just over £4 which is up from last year at this time but is still well below the high it achieved just 2 years ago.

The only company that apparently is challenging Betfair in terms of revenue is Bet365 which had reveue of £1.3 billion in 2014 but as a private company it's impossible to compare them in terms of stock price. It's difficult to compare Betfair to other exchanges since only two others really exist – Sporting Index and Matchbook. I have been told that Matchbook is a tiny exchange that has a few loyal customers but gets nowhere near the volume of Betfair and Sporting Index was sold after last year's World Cup by Hg Capital to a private investor for an estimated £40 million. Needless to say if Hg Capital wanted out, the company must be performing below expectations.

Betfair has also made some small acquisitions including purchasing the HRTV horse racing network from the Stronach group earlier this year which it merged with TVG to provide one platform for all horse racing and providing more betting options on U.S. racing for its European customers.

"This deal strengthens TVG's position as a significant player in the US horseracing industry, bringing together the US' leading racetracks under a single TV network for the first time." Corcoran announced in a press release after completion of the deal. "The enlarged TVG operation will now show the most exciting racing action globally whilst offering a world-class betting experience. We believe this is a very compelling proposition for our customers".

Of course Betfair has bigger plans for the U.S. If exchange betting is allowed in the United States then Betfair will be on it. The exchange betting option was delayed for 2 years in 2014 by the California Horse Racing Board due to protests by Frank Stronach among others but with the recent purchase and with the simmering down of objections to foreign operators it's quite possible Stronach will have less say when it comes up for discussion again. And if online sports betting is ever legalized in the United States there's no doubt Betfair will be the first in line to offer wagering on the product and with the current presence they should have no problem getting approval and signups.

The past few years have been trying times for online gambling companies worldwide as bettors have been wagering less due to the recession and regulatory hurdles have made it hard for companies to operate profitably in various markets. But Betfair has shown that with good planning and leadership it can still be done.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!